Best Place To Exchange Foreign Money Hassle-Free, Fast & 100% Guaranteed

Posted by: Ian Stainton • 18 Dec 2025

If you’re looking to turn leftover foreign coins, leftover holiday money and notes into pounds almost instantly, your best bet is a regulated UK online provider or a high-street bureau de change that sticks to interbank rates. These options are fast, easy, entirely hassle-free, 100% guaranteed, and require no coin sorting—so you can convert foreign coins and banknotes without breaking a sweat. We’re trusted by major brands, including charities, supermarkets, airports and police forces, for providing secure, transparent service every time.

Quickest Options To Exchange Foreign Money

Picking where to send your foreign coins and notes can feel overwhelming. Focusing on speed, cost and security makes the decision crystal clear when you need to exchange foreign coins and notes, or convert leftover foreign currency.

- 24–48 hours turnaround from posting to receiving pounds.

- No sorting required – seal coins and notes in one envelope.

- No hidden charges once your package is in the mail.

- 100% payout guaranteed or your currency returned free of charge.

- Trusted by charities, supermarkets, airports and police forces.

“With no coin-sorting or weight-based hassles, you spend minutes packing rather than hours counting fees and headaches.”

In practice, sending unsorted currency is as simple as dropping a letter in the post.

Key Benefits At A Glance

- 100% payout assured across every supported currency.

- Prepaid packaging takes the guesswork out of mailing.

- Choose between PayPal, bank transfer or donating unneeded coins to charity.

- Exchange rates are transparent before you dispatch.

Whether you’ve got a handful of coins, leftover holiday money or a suitcase of notes, these speedy, secure solutions adapt to every situation.

Comparison Of Top Currency Exchange Options

Below is a quick snapshot of the most popular routes, rated by speed, fees, safety and convenience.

| Option | Speed | Typical Fees | Safety | Convenience |

|---|---|---|---|---|

| Online Regulated Provider | 24–48 hours | Low spread + flat fee | FCA-regulated, insured | Mail-in, no sorting |

| High-Street Bureau | Instant | 1–3% spread | Well-known brands, audit trails | Walk-in, easy access |

| Airport Kiosks | Immediate | 2–5% spread | High foot traffic, secure | In-terminal desks |

Use this overview to decide which exchange method suits your timeline and fee preferences. Find the best place to exchange foreign money today at We Buy All Currency.

Understanding Key Concepts Of Foreign Currency Exchange

Before you decide where to swap your leftover euros, yen or dollars, it’s worth untangling a few core ideas of currency conversion. Think of the mid-market rate as the wholesale price of apples at your local farmers’ market—clean, simple and free from mark-ups. Exchange providers then add their own margin, known as the spread, to cover costs and profit.

At the same time, you might encounter:

- Flat Fee: A fixed charge no matter if you’re sending £10 or £1,000

- Commission: Similar to buying fruit by weight—it rises with your total amount

- Insured Shipment: A guarantee that your package of coins and notes arrives safely

For instance, a 0.5% spread on a €100 bundle could net you a few extra pounds, whereas a £5 flat fee often suits small exchanges better when you want to convert foreign coins and banknotes.

Spreads And Fees Explained

Once you know what each fee covers, matching it to your situation becomes straightforward. Flat fees give you certainty—you know exactly what you’ll pay. By contrast, a low percentage spread often works out cheaper for larger sums.

“Compare every quote apples-to-apples to avoid surprises.”

High-street bureaux de change promise instant service but can charge spreads of 3% or more. Online and mail-in providers, however, usually offer transparent flat fees, 100% guaranteed payouts and optional insured postage—you see your net amount before you commit.

Why Transparency Matters

Clear, upfront quotes are the foundation of trust. When you know exactly what you’ll receive, there are no hidden surprises. That peace of mind comes from:

- Partnerships with charities, supermarkets, airports and more

- Full regulation and insurance for your protection

- 100% guaranteed payouts—or we return your currency at no cost

Armed with transparent pricing, you can confidently exchange foreign coins and notes without any unwelcome deductions.

Choosing Fee Structures

Imagine your mixed coins and notes as a fruit salad—you wouldn’t sort every slice of strawberry before tossing it all in a bowl. Similarly, send your notes and coins together: it streamlines packing and speeds up processing.

- Compare mid-market rates against the provider’s offer

- Skip home sorting—post coins and notes in one package

- Opt for speed if you need your funds urgently

If your pile is mostly coins, a spread-based fee might work in your favour. Smaller notes? A flat fee probably makes more sense. Our weight-based calculator takes out the guesswork—just pack everything into our prepaid envelope and post it off. You’ll see your rate first, and if you’re not happy, your currency comes straight back—our 100% guarantee.

Finally, remember to save your postage receipt—it’s your proof of shipment and helps you track your order. With these fundamentals in hand, you’re set to reclaim every penny of your leftover foreign currency, securely and hassle-free.

Comparing Exchange Methods For Foreign Currency

Choosing how to exchange foreign notes and coins often feels like picking transport for a journey: you might pay extra for a high-speed train or save by taking a slower bus. Each option—high-street banks, bureaux de change, airport kiosks, online mail-in services and FCA-regulated FX brokers—has its own trade-offs in speed, fees, safety and ease.

High-street banks let you walk in and swap cash with spreads of 1–3%, backed by familiarity and regulation. Bureaux de change can surprise you with sharp rates, but they swing widely depending on location and time of day. Airport kiosks deliver instant exchange at 2–5% spreads, though that convenience carries a premium. Meanwhile, online mail-in services and FCA-regulated brokers settle in 1–3 business days, often charging a low flat fee or volume-based spread.

No single channel trumps the rest—your best pick depends on whether you value instant cash, the lowest cost or a fully insured transaction.

Why London Liquidity Matters

London dominates the FX arena, handling 37.8% of global daily turnover. That clout tightens bid-ask spreads and cuts hidden costs for every swap.

Recent Bank of England / BIS figures show UK FX daily turnover jumped to $4,745 billion in April 2025 from $3,735 billion in April 2022. More volume means deeper pools of buy-sell orders and smoother executions, benefiting holiday-makers and big corporates alike.

Read the full BIS survey insights about London FX turnover. Learn more about London market share.

Fee Speed And Safety Comparison

Below is a quick overview of the main exchange channels, side by side:

| Method | Speed | Fees | Safety | Ease |

|---|---|---|---|---|

| High-Street Banks | 1–2 days | 1–3% spread | Established brands, regulated | Walk-in service |

| Bureaux de Change | Instant | 1–4% spread | Monitored counters | High street access |

| Airport Kiosks | Immediate | 2–5% spread | Secure kiosks | Terminal desks |

| Online Mail-In Services | 24–72 hours | Low flat fee | FCA-regulated, insured postage | No sorting required |

| FX Brokers | 1–3 days | Tight spreads | Regulated, electronic execution | Online platform |

Use the table to match your priorities:

- If you need cash now, airport kiosks win hands down.

- To keep fees at a minimum, online mail-in services or brokers often come out ahead.

- For peace of mind, stick with FCA-regulated providers or your bank.

- If you’re fed up with counting coins, mail-in options eliminate sorting.

“Fast, easy and 100% guaranteed, no coin sorting needed,” says one happy customer.

We’re trusted by charities, supermarkets, airports and police forces. No messy bundles, transparent fees and a happiness guarantee mean you can see your payout before you even post.

You might also find our detailed foreign currency exchange comparison guide useful.

Explore our comparison guide

When weighing up your choice, keep these real-world tips in mind:

- For loose change, flat-fee mail-in services stop per-coin costs.

- Large banknote sums often get better rates through FX brokers.

- Banks trade only on weekdays from 9 am–3 pm, while online platforms update mid-market rates 24/7.

- Tourist-area bureaux can pinch with wide spreads, so shop around.

- Mail-in services skip queues but factor in posting time and secure packaging.

- FX brokers suit businesses but may insist on minimum volumes.

Always focus on the net amount landing in your account, not just the advertised rate.

Finally, with our weight-based wizard you can estimate your coins’ worth in seconds. No need for coin rolls or sorted envelopes—just slide everything into a pre-paid pouch. Every order is insured, and we even accept obsolete or pre-euro currencies.

See full terms and supported currencies on our homepage. Visit We Buy All Currency for guaranteed exchanges.

How To Choose The Right Exchange Option

Picking the right way to swap your currency really comes down to three things: how much you have, how urgently you need cash and whether you want the lowest spread or a flat fee. Different situations call for different tools.

- Travellers with loose coins can skip the counting and use mail-in services for a fast payout.

- Households with a handful of mixed notes often save most by choosing an online service with a flat fee.

- Charities collecting donations benefit from platforms that handle unsorted bundles and make giving effortless.

- Businesses moving money regularly should look for brokers that offer volume discounts, live rate feeds and transparent fees.

Criteria For Choosing An Exchange Channel

When you’re weighing up your options, keep these factors front of mind:

- Speed: Do you need pounds in your account within hours or days?

- Fees: Are you comfortable with a percentage spread, or do you prefer a set handling charge?

- Convenience: Would you rather sort coins yourself or send everything in one package?

- Trust: Is the provider regulated and backed by reputable institutions?

- Guarantee: Does the service promise a 100% payout or at least a return on your shipment?

Why Timing And Venue Matter

Even slight shifts in exchange rates can make a noticeable dent in your returns. According to ONS data, the USD/GBP rate averaged between 1.25–1.40 from 2021 to 2024 and sat at 1.3566 in June 2025. A 5% swing on a £1,000 exchange means £50 lost—often more than a standard retail commission.

Different providers update their rates at varying intervals. High-street banks tend to refresh during UK trading hours, while online platforms track mid-market rates 24/7.

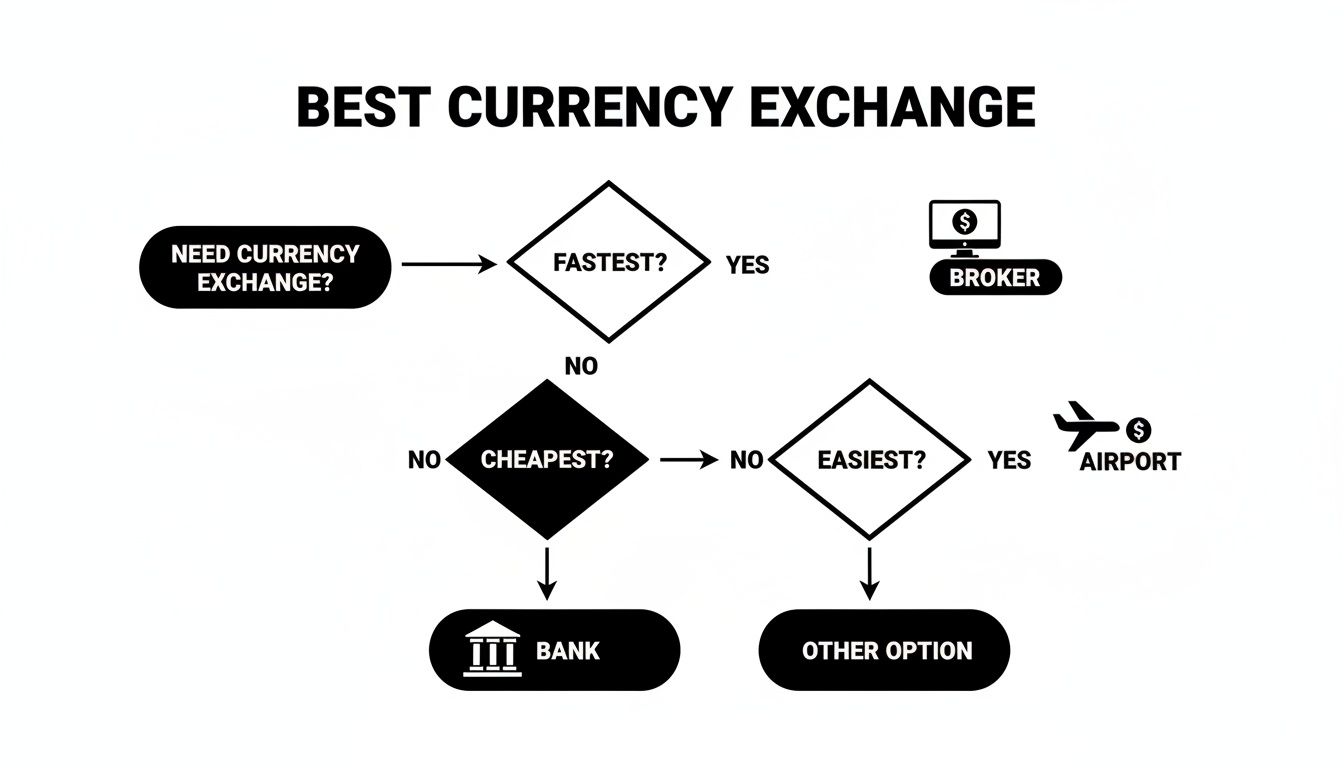

The following infographic visualises whether you prioritise speed, cost or ease when picking a provider.

This chart shows that brokers win on speed, banks win on cost and airport kiosks win on ease.

Balancing Cost And Convenience

Going for the absolute cheapest option isn’t always the simplest route. Spread-based fees are like paying a taxi fare per mile—you’ll save if you’re covering long distances. Flat charges are more like buying a bus ticket: predictable and perfect for short hops.

If you’re travelling light, a flat fee might be the smarter pick. But if you’re moving a large sum, spreads typically work out better.

Key Trade Offs

- Spread Fee: Best for big amounts but rises with your volume

- Flat Fee: Predictable and ideal for small or mixed batches

- Venue Timing: Airport kiosks update around midday; banks stick to market hours

- Online Refresh: Platforms mirror live mid-market rates all day, every day

Always check the net payout displayed before you send your parcel of coins and notes.

Mapping Options To Scenarios

-

Traveller Coin Exchange

- Mail-in services for unsorted coins with a 24–48 hour turnaround

-

Household Note Exchange

- Flat-fee providers for mixed banknotes to dodge volume-based charges

-

Charity Donation

- Partners endorsed by charities, supermarkets and police forces for full transparency

-

Business Recurring Transfers

- Regulated FX brokers offering live feeds and tiered discounts

Fast, easy, hassle-free and 100% guaranteed, no sorting required

Focusing on net payout and avoiding hidden costs ensures you always get the best value. With these guidelines, finding the perfect place to exchange foreign coins and notes is straightforward. Start today with confidence at We Buy All Currency.

Step By Step Mail In And Online Currency Exchange

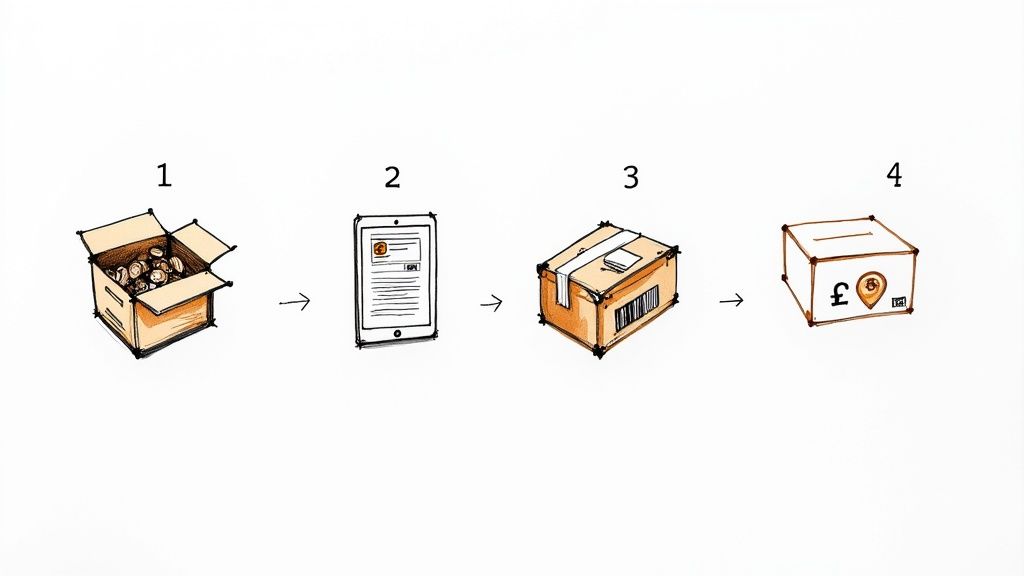

Sending your spare foreign coins and notes by post can feel like tucking your money into a secure vault. It’s often the quickest, most stress-free way to convert foreign coins and banknotes and exchange foreign coins without ever visiting a branch.

In this guide, you’ll learn how to pack everything together, complete a simple online form, track your shipment in real time and receive payment—usually within 48 hours.

Our approach is fast, easy, hassle-free and backed by FCA-regulated protection. Trusted by charities, supermarkets, airports and even police forces, our service gives you rock-solid security and clear, upfront rates every time.

Preparing Your Currency

First, gather all your leftover foreign coins, leftover foreign currency and notes in one spot—no sorting or coin-rolling required. It’s like tossing everything into a single suitcase before a trip.

Use our prepaid, tamper-evident pouch so nothing slips out en route to our processing centre. This one-step packaging removes the risk of loss and keeps things simple on arrival.

- Use Sturdy Packaging to ward off bending or moisture damage.

- Include Cardboard Separators if you’ve got stacks of notes to prevent creases.

- Seal the Pouch Securely with the supplied tape for full insurance coverage.

“By packing everything together, you save time and reduce handling errors,” says a currency exchange specialist.

Shipping And Tracking

Next, take your sealed pouch to any Royal Mail or courier drop-off point. You decide which tracked option best fits your schedule.

- Affix the prepaid label firmly to the pouch.

- Snap a photo or scan the barcode and label for your records.

- Ship via a tracked service, for example Royal Mail Signed For 2nd Class or a courier.

- Enter your tracking number online to watch each step of the journey.

| Service | Speed | Cost | Insurance |

|---|---|---|---|

| Royal Mail Second Class | 2–3 days | £3.00 | Up to £50 |

| Royal Mail Signed For | 1–2 days | £4.50 | Up to £100 |

| 24 Hour Courier | 1 day | £8.00 | Up to £250 |

“Tracking gives you peace of mind and full visibility from drop-off to processing.”

Confirmation And Payment

Once your pouch arrives, we start verification right away. Most packages clear inspection in 48 hours.

You’ll receive email updates at every milestone—arrival, counting, payout approval—so you always know where things stand.

When the final green light hits, your funds go out via bank transfer, PayPal or straight to a charity of your choice. We show you the exact payout before you send and guarantee 100% of that amount.

For more details on using our secure online exchange platform, check out our guide on exchange foreign currency online.

Practical Tips

Timing is everything. Ship on a weekday to skim days off Royal Mail handling.

- Plan your drop-off for mid-week to dodge weekend backlogs.

- Keep your proof of posting until the payment clears.

- Try our weight-based wizard to get an instant payout estimate.

- Bundle obsolete or pre-euro coins together—yes, we accept them all.

“I shipped on a Wednesday and got paid in 48 hours – hassle-free,” says Emma, a frequent traveller.

Insurance And Safety

Every order comes with guaranteed insurance and is processed under FCA-regulated protocols.

| Feature | Detail |

|---|---|

| Insurance | Up to £250 per shipment |

| Regulation | FCA-regulated platform |

| Guarantee | 100% payout or return free |

Examples Of Successful Exchanges

Jane returned from holiday with a handful of coins totalling €60. She tossed them unsorted into our pouch and saw £52 land in her PayPal account within 48 hours.

Paul, a charity coordinator, sent a 10 kg mix of notes and coins. He directed half the proceeds to his chosen charity—no extra fees applied.

Say goodbye to queues and sorting. This is the best place to exchange foreign money with full transparency and no hidden charges.

Ready to reclaim your leftover foreign currency?

Visit We Buy All Currency now for a fast, easy, hassle-free exchange with a 100% guarantee.

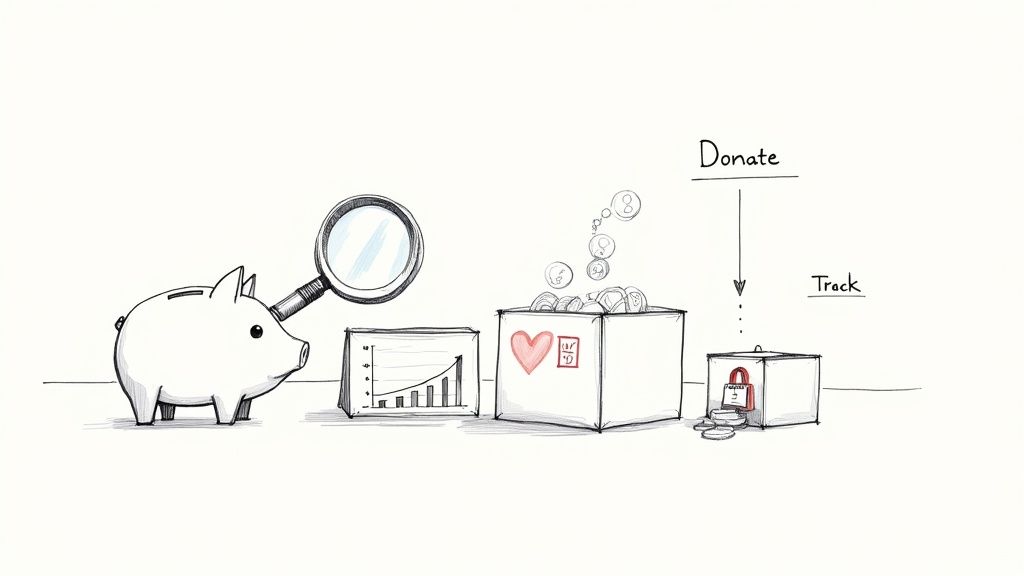

Tips To Maximise Value And Donate Foreign Currency

Got a handful of stray euros, dollars or yen? A little strategy goes a long way. By choosing the right day, watching mid-market rates and opting to donate foreign coins to charity, you’ll squeeze every last penny out of your foreign notes and coins.

We’ve fine-tuned a service that’s quick, straightforward and 100% guaranteed, so there’s no need to sort coins by currency or denomination.

- Weekday Timing narrows spreads for more pounds.

- Live Rate Tools mirror interbank prices in real time.

- Obsolete Currency and old coins are all welcome.

- Charity Option lets you gift spare coins at zero cost.

A well-timed exchange can be worth an extra few pounds. Mid-week, when banks and brokers trade heavily, you’ll often see the smallest spreads. By contrast, weekends and public holidays bring thinner markets—and wider margins.

Price calculators give you a clear payout preview. Our weight-based wizard tallies thousands of mixed coins in seconds. Blend these insights for the best spot to trade or donate your currency.

When To Exchange For Best Rates

Timing your exchange is like catching a train: miss it, and you pay a premium. Data shows spreads on GBP/EUR and GBP/USD are 0.1–0.2% tighter on Tuesdays and Wednesdays.

| Weekday | Typical Spread | Commentary |

|---|---|---|

| Monday | 0.25% | Markets re-open after the weekend |

| Tuesday | 0.15% | Peak interbank turnover |

| Wednesday | 0.12% | Highest liquidity mid-week |

| Thursday | 0.18% | Slight drop after the mid-week surge |

| Friday | 0.22% | Closing ahead of the weekend |

Weekends often carry wider margins thanks to lower volumes and closed banks. Aim for:

- Tuesdays 10–12 GMT for a mid-week sweet spot.

- Wednesdays 08–10 GMT when liquidity peaks.

- Thursday afternoons before weekend slow-down.

Finish your exchange by Friday afternoon to dodge the weekend gap and wider spreads.

How To Track Mid Market Rates

Keep a close eye on the mid-market rate with browser extensions or mobile apps.

For instance, the XE app pings you once your target rate hits the interbank level. Set up alerts for your currency pair and choose email or push notifications. That way, you jump in exactly when the market swings in your favour.

Accurate rate alerts help you seize opportunities and avoid guesswork.

Compare live charts before posting your currency:

- XE for straightforward alerts.

- Bloomberg for in-depth market data.

- OANDA for tailored notifications.

Reclaim Obsolete Currency And Small Coins

Your jar of old drachma or worn Soviet roubles isn’t worthless. Our weight-based wizard counts mixed coins and notes without any need to sort them yourself.

Follow these four simple steps:

- Weigh your currency at home or estimate it online.

- Pack coins and notes together in one envelope.

- Affix our prepaid label and ship.

- Receive your funds within days, guaranteed.

We accept a wide range of withdrawn money:

- Pre-decimal British coins (eg 1d, 2d)

- Old Irish punts and cent coins

- German Deutsche marks and Pfennig

- French francs and Belgian francs

Effortless Charity Donations And Next Steps

Donating leftover coins costs you nothing. At checkout, simply tick the donation box and select a UK charity partner. Every penny helps:

- Save the Children

- RSPCA

- British Red Cross

- Marie Curie

Read also our detailed guide on where to donate foreign coins for more insights

Check out where you can donate foreign coins

You’ll receive a confirmation receipt for your records—and the satisfaction of knowing your spare change supports vital causes at home and abroad.

Maximise your returns or turn them into donations today. Visit our homepage now: We Buy All Currency.

Frequently Asked Questions About Foreign Currency Exchange

If you’ve been hunting for a service that makes exchanging foreign coins and notes quick, simple and 100% guaranteed, you’re in the right place.

Preparing Currency For Mail-In Exchange

Q: How Should I Prepare Coins And Notes For Mail-In Exchange?

Just drop your unsorted coins and banknotes into the tamper-evident pouch we provide. Seal it, slip in your completed form, and you’re done—no sorting by denomination or currency needed.

“Skipping the sorting step can turn a tedious task into a five-minute job,” says a currency exchange specialist.

Packing Tips

- Use the prepaid, tamper-evident envelope to keep everything secure.

- Slide in cardboard dividers for banknotes to prevent creases.

- Hold onto the postage receipt for tracking and proof of shipment.

Fees And Turnaround Times

Q: What Fees Can I Expect When Using Online Currency Exchange?

Most regulated providers add a small spread over the interbank rate plus a flat handling fee. Every charge appears up front, so there are no hidden surprises when you send off your coins and notes.

Q: How Long Will It Take To Receive My Funds After Shipment?

Once your package arrives at our processing centre, we aim to issue payment within 24–48 hours. You’ll get email alerts at each stage, so you can see exactly where your money is.

Typical Timeline

- Drop off your pouch via Royal Mail or a courier.

- Processing and verification in 1–2 days.

- Funds land in your bank, PayPal or charity account.

Donating Leftover Currency

Q: How Do I Donate Foreign Coins To Charity?

At checkout, simply tick the donation box or choose a partner charity. Your coins go straight to good causes with zero fees, and we’ll email you a confirmation receipt.

Q: Can I Convert Old Or Obsolete Currency?

Yes—pre-euro coins, withdrawn banknotes and other out-of-circulation currency are all accepted. Our guaranteed service ensures you reclaim every penny of your old change.

We’re trusted by major brands—charities, supermarkets, airports and even police forces. For friendly UK support, just drop us an email or give us a call.

Exchange your foreign coins and notes with complete confidence at We Buy All Currency.