7 Best Places to Exchange Foreign Currency in the UK (2025)

Posted by: Ian Stainton • 25 Nov 2025

Returning from a trip abroad often means coming home with a pocketful of foreign coins and a few leftover banknotes. For many, this currency ends up in a jar on a shelf, its value forgotten and seemingly too much hassle to exchange. But what if you could easily convert that entire collection—whether it's current Euros, old French Francs, or a heavy mix of unsorted world coins—directly into sterling? This guide reveals the best places to exchange foreign currency in the UK, helping you unlock that hidden value in a fast, easy, and hassle-free way.

We'll dive into a curated list of seven top options, from familiar high-street names like the Post Office and Tesco to innovative online platforms. Our goal is to provide a comprehensive roundup, giving you clear, practical tips and real-world insights into each service. You will learn the specific pros, cons, and ideal use cases for traditional bureaux de change, specialist online buyers, and even peer-to-peer services. We'll show you exactly when to choose a particular method to maximise your return, whether you want to exchange foreign coins, convert leftover foreign currency, or even find a home for old or obsolete currency.

This article cuts through the confusion, offering a straightforward comparison to help you find the perfect solution for your needs. We'll explore fast, easy, and hassle-free exchange processes, some of which are 100% guaranteed and require no tedious coin sorting on your part. Trusted by major UK brands including charities, supermarkets, airports, and even police forces, these services provide a credible way to exchange foreign coins and notes or donate foreign coins to charity. Let's find the best home for your leftover travel money.

1. We Buy All Currency: The Specialist for All Coins & Notes (Current or Obsolete)

For anyone with a drawer full of mixed foreign currency, We Buy All Currency stands out as an exceptionally comprehensive and user-friendly online solution. This UK-based platform has carved a unique niche by addressing a common traveller's headache: what to do with leftover foreign currency, especially coins and old banknotes that traditional exchanges refuse. It provides a fast, easy, and hassle-free service designed specifically to convert all foreign coins and banknotes, whether they are current, obsolete, or even from pre-euro currencies.

Unlike high street banks or airport bureaux de change that typically only accept current banknotes, this service accepts the lot. This makes it one of the best places to exchange foreign currency when you have a jumbled collection of different denominations and types. Their process is built on trust and credibility, earning them the confidence of major UK brands, including national charities, supermarkets, airports, and even police forces that use the service to handle their own foreign currency collections.

What Makes It Stand Out?

The primary advantage of We Buy All Currency is its all-encompassing acceptance policy. If you have unsorted shrapnel from multiple holidays or have inherited a collection of outdated money, this platform can turn it into spendable cash.

- No Sorting Required: Their intuitive online wizard allows you to get an estimate based on the total weight of your coins, saving you the tedious task of sorting them by currency or denomination. Forget sorting coins; just send them in!

- Complete Transparency: The process is 100% guaranteed. You receive a quote before committing, and if you are not satisfied with the final valuation after they receive your currency, it will be returned to you completely free of charge.

- Charitable Giving: The platform offers a seamless option to donate your proceeds directly to one of their partnered UK charities, making it an excellent way to donate foreign coins to charity and turn leftover currency into a meaningful contribution.

The Exchange Process Explained

The service is designed for maximum convenience. You start by filling out an online form, detailing the currency you have (or using the weight-based estimator for mixed coins). You then post your coins and notes using their clear packing guidance. Once received, the currency is processed, and payment is issued within five working days via UK bank transfer or PayPal. This straightforward postal system is a core part of their fast and easy operation. If you're looking for guidance on different exchange methods, you can learn more about how to exchange foreign currency on their website.

Who Is It Best For?

This service is ideal for a wide range of users in the UK, from individuals to large organisations.

- Travellers: Perfect for converting leftover holiday money, especially the foreign coins that other providers reject.

- Inheritors: A simple, hassle-free solution for those who have discovered collections of old or obsolete currency and want to unlock its value.

- Charities and Businesses: An efficient partner for organisations that receive foreign currency donations or payments and need a reliable way to convert them.

| Feature Analysis | We Buy All Currency | Traditional Exchanges (e.g., Banks, Post Office) |

|---|---|---|

| Coins Accepted? | Yes, all foreign coins | No, typically banknotes only |

| Obsolete Currency? | Yes, including pre-euro | No |

| Sorting Required? | No, weight-based option available | N/A (as they don't accept coins) |

| Service Method | Online postal service | In-person at a physical branch |

| Best For | Unsorted, mixed, and old currency | Exchanging current, high-value banknotes |

| Convenience | Post from home | Immediate cash but requires travel |

Pros:

- Accepts any currency, any age, including obsolete and pre-euro money.

- Transparent, 100% guaranteed process with free returns.

- Weight-based wizard simplifies selling unsorted coin collections.

- Trusted by major UK brands like charities, supermarkets, airports, and police forces.

Cons:

- Value is based on a formal quote, not fixed rates published on the site.

- Requires posting your currency, so it is not an instant cash service.

- Payment and charity options are primarily UK-focused.

For anyone looking to exchange foreign coins and notes without the usual limitations, We Buy All Currency offers an unmatched, reliable, and highly specialised service.

Website: https://www.webuyallcurrency.com

2. Post Office Travel Money

As the UK’s largest high-street travel money provider, Post Office Travel Money offers a familiar and trusted presence for travellers looking to buy foreign currency. Its extensive network of branches makes it one of the most accessible options for in-person services, a significant advantage for those who prefer face-to-face transactions over purely online interactions. This service is primarily focused on buying currency for your trip, but its buyback scheme also provides a straightforward way to handle leftover notes.

The platform is ideal for securing popular currencies like Euros or US Dollars, often available for immediate collection. For those planning ahead, ordering online offers better rates than walking into a branch, with the flexibility of home delivery or click-and-collect.

Key Features and Services

The Post Office provides a comprehensive suite of services designed for convenience and reliability. Its offering is well-suited for travellers at both the beginning and end of their journeys.

- Wide Currency Selection: Over 60 currencies are available to order, covering most popular holiday and business destinations.

- Flexible Collection & Delivery: You can order online for free next-working-day home delivery on amounts over £500 (a £4.99 fee applies to smaller orders). Alternatively, use the Click & Collect service, with major currencies often ready in as little as two hours at selected branches.

- Prepaid Travel Money Card: For those seeking a secure alternative to cash, the reloadable Travel Money Card supports 22 currencies, allowing you to manage your spending abroad without carrying large amounts of banknotes.

- Commission-Free Buyback: If you have leftover currency notes after your trip, the Post Office will buy them back commission-free, provided you have your original purchase receipt.

Pros and Cons Analysis

While the Post Office is a strong contender for one of the best places to exchange foreign currency, it's important to weigh its strengths and weaknesses.

| Pros | Cons |

|---|---|

| Vast Branch Network: Unparalleled physical presence across the UK. | Rate Discrepancies: Online rates are often better than branch rates. |

| Trusted Brand: A long-established and reliable name in the UK. | Notes Only Buyback: The service does not accept foreign coins. |

| Commission-Free Buyback: Straightforward process with an original receipt. | Markup on Rates: Exchange rates include a margin over the mid-market rate. |

Practical Tip: Always check the online exchange rate before visiting a branch. You can often secure a better deal by ordering online for collection, even if you plan to pick it up the same day. This simple step ensures you get the most value from your exchange.

In summary, Post Office Travel Money excels in convenience and accessibility, making it an excellent choice for buying currency and selling back leftover banknotes. Its vast network means you're never far from a branch, offering a level of trust and in-person service that digital-only platforms cannot match.

Website: https://www.postoffice.co.uk/travel-money

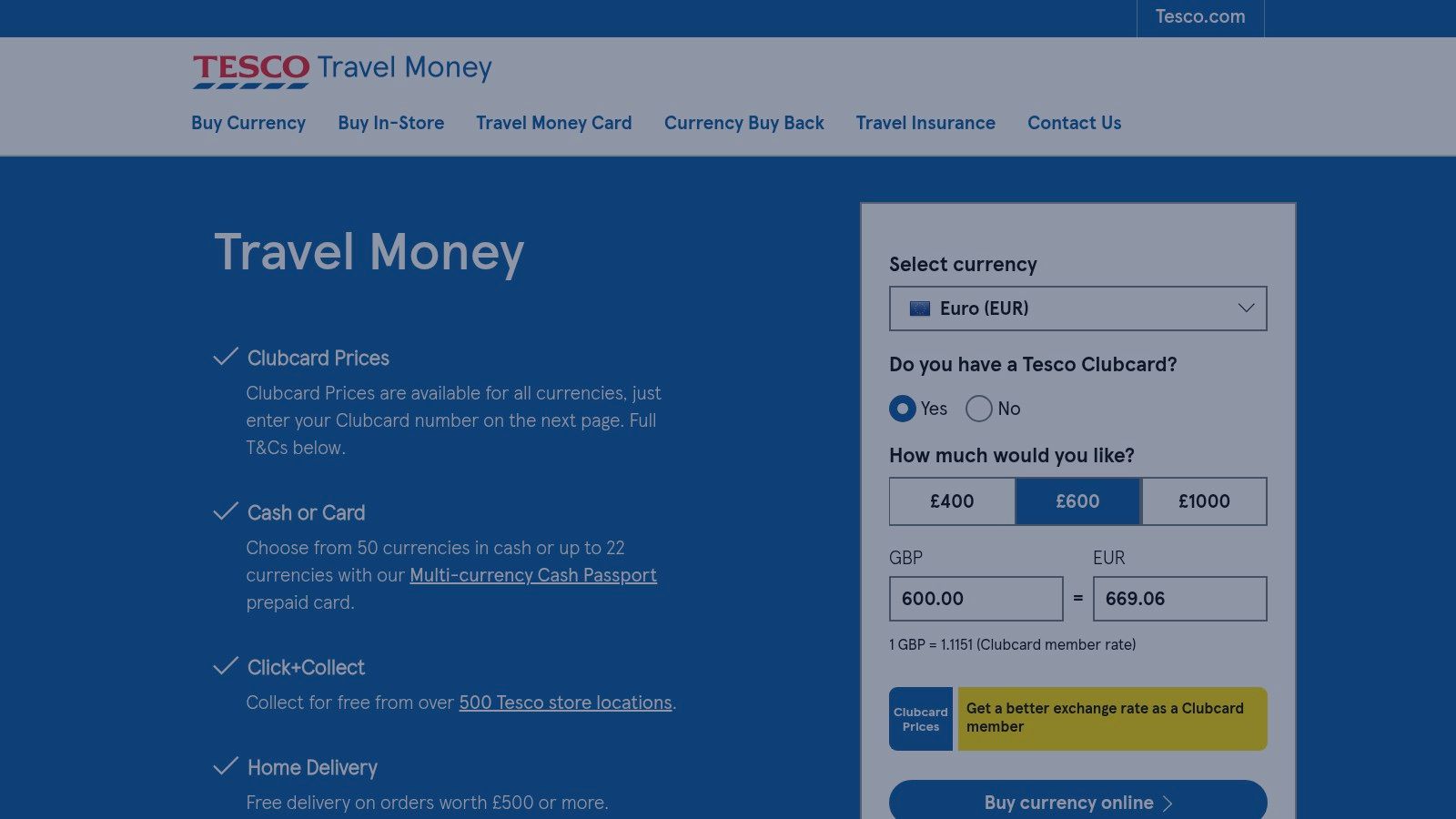

3. Tesco Travel Money

Leveraging its extensive retail footprint, Tesco Travel Money offers a highly convenient and accessible service for travellers. As a trusted supermarket brand, it integrates foreign currency exchange into the weekly shop, making it an excellent option for those looking to combine errands. This service, powered by Travelex, is particularly beneficial for Tesco Clubcard holders, who can access preferential rates.

The platform is designed for ease of use, allowing customers to order currency online for home delivery or collection at an in-store bureau. This blend of digital convenience and physical presence makes it a strong contender for one of the best places to exchange foreign currency, especially for those who value familiarity and the potential for loyalty rewards.

Key Features and Services

Tesco provides a streamlined set of services focused on making currency exchange as simple and integrated into daily life as possible.

- Clubcard Member Rates: Tesco Clubcard holders can benefit from improved exchange rates, adding extra value for loyal shoppers.

- Flexible Fulfilment: Order online for free home delivery on currency purchases over £500 (a £4.99 fee applies to orders between £100 and £499.99). Alternatively, use the Click & Collect service available at hundreds of Tesco stores across the UK.

- Broad Currency Selection: A wide range of popular currencies are available, covering the vast majority of holiday and business travel destinations.

- Prepaid Travel Card: The Tesco Bank Multi-currency Cash Passport is a prepaid Mastercard that allows you to load up to seven different currencies, offering a secure way to manage funds abroad.

Pros and Cons Analysis

While Tesco Travel Money offers significant convenience, it is important to consider its advantages and limitations before making a decision.

| Pros | Cons |

|---|---|

| Convenient Collection: Pick up currency during your regular shop. | Rate Variation: Rates can differ between online and in-store channels. |

| Competitive Member Pricing: Clubcard holders often get better rates. | No Order Amendments: Once placed, delivery orders cannot be changed. |

| Trusted Supermarket Brand: A familiar and reliable name for millions. | Markup on Rates: Exchange rates include a margin over the mid-market rate. |

Practical Tip: If you're a Tesco Clubcard member, always log in or present your card when ordering. The member-exclusive rates can offer a noticeable saving, ensuring you get more travel money for your pounds. Check both the online and in-store rates to find the best deal.

In summary, Tesco Travel Money is an excellent choice for convenience-focused travellers, particularly existing Tesco customers. The ability to collect currency from a local supermarket and benefit from Clubcard pricing makes it a seamless and often cost-effective option for preparing for your trip.

Website: https://www.tescotravelmoney.com

4. Travelex UK

As a global leader in foreign exchange, Travelex UK is a highly recognisable and convenient option for travellers. With a strong presence at airports and in major city centres, it offers a reliable service for those needing currency at short notice or preferring to handle transactions in person. Travelex specialises in providing currency for your travels and buying back leftover notes, making it a comprehensive solution for holidaymakers.

The platform is particularly well-suited for travellers who value flexibility. By ordering online, you can secure better exchange rates than you would by walking up to an airport counter, with the choice of convenient home delivery or collection from one of their numerous bureaux de change.

Key Features and Services

Travelex provides a range of services designed to make foreign currency exchange secure and straightforward, whether you're planning in advance or need cash at the last minute.

- Multiple Fulfilment Options: Order online for home delivery, which is free for orders over £600 (tiered fees apply for smaller amounts). Alternatively, use the Click & Collect service to pick up your money from an airport or high-street location.

- Travelex Money Card: A secure, prepaid Mastercard that allows you to load up to 15 different currencies. It offers a safe and manageable way to spend abroad without carrying large quantities of cash.

- Buy Back Promise: For a small fee, Travelex guarantees they will buy back any leftover banknotes at the original transaction exchange rate, providing peace of mind against fluctuating currency values.

- Wide Airport Presence: Its extensive network of airport locations makes it one of the best places to exchange foreign currency if you've left it to the last minute or prefer the convenience of collecting your money just before you fly.

Pros and Cons Analysis

Travelex's blend of online convenience and physical locations offers significant benefits, but it's important to consider the trade-offs.

| Pros | Cons |

|---|---|

| Strong Airport Presence: Ideal for last-minute collections. | Weaker Airport Rates: Walk-up exchange rates are less competitive. |

| Flexible Options: Home delivery, Click & Collect, and card choices. | Delivery Fees: Charges apply for home delivery on orders under £600. |

| Buy Back Promise: Optional protection against rate fluctuations. | Notes Only Buyback: Like most providers, Travelex does not accept foreign coins. |

Practical Tip: To get the best value from Travelex, always order your currency online in advance. Even if you plan to collect it from an airport branch, pre-ordering locks in a much better exchange rate compared to the standard over-the-counter rate offered to walk-up customers.

In summary, Travelex UK excels in providing a flexible and accessible service, especially for travellers who appreciate the security of collecting their currency at the airport. Its combination of online ordering, a prepaid card, and an extensive physical network makes it a trusted and versatile choice.

Website: https://www.travelex.co.uk/travel-money

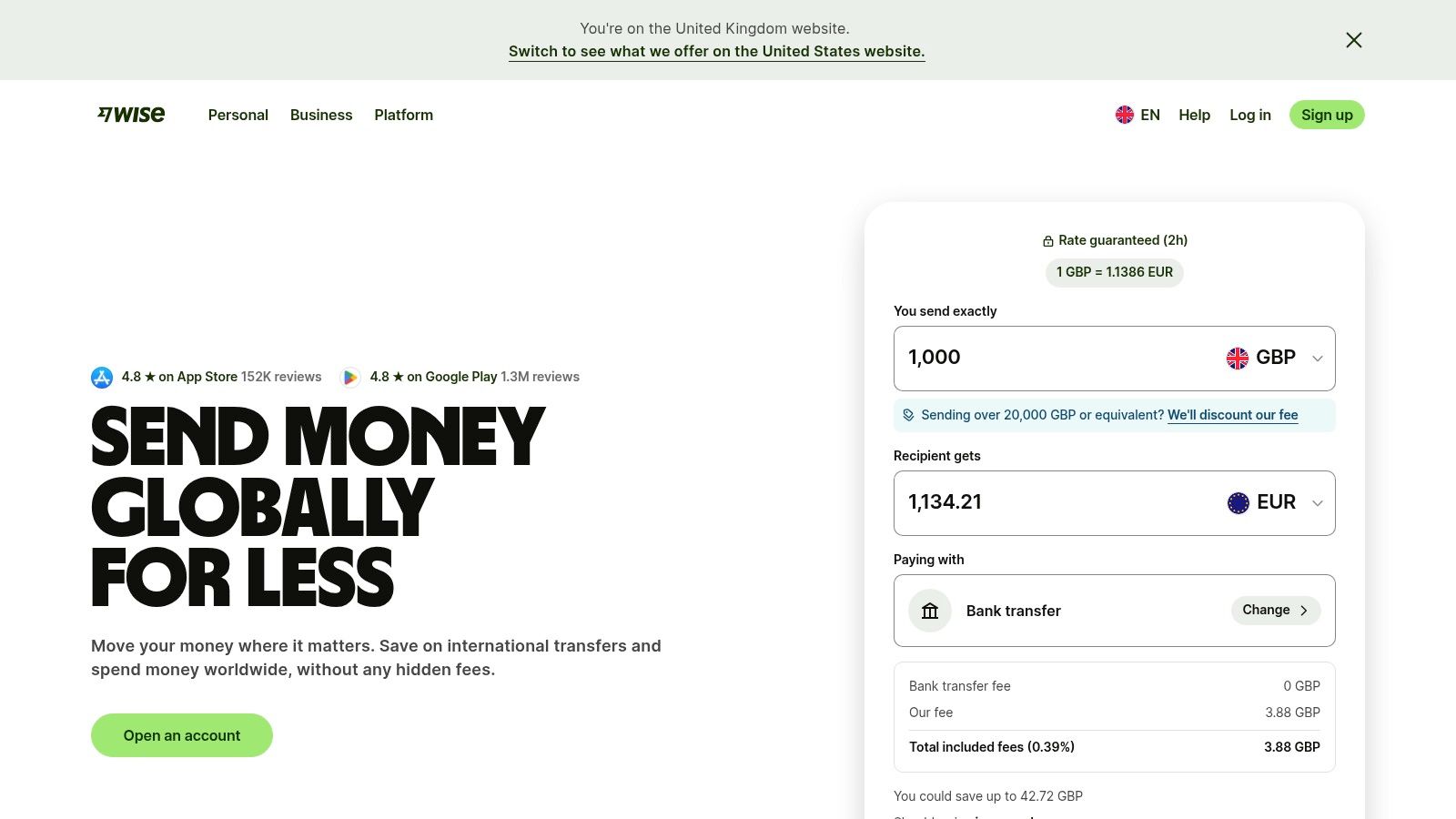

5. Wise (formerly TransferWise)

Wise has revolutionised the world of international finance by offering a digital-first approach to currency exchange. Rather than dealing in physical cash, Wise provides a multi-currency account and debit card designed for travellers and global citizens who need to hold, spend, and send money in different currencies. Its core appeal lies in using the real mid-market exchange rate, making it one of the most transparent and cost-effective platforms available. This makes it an excellent choice for managing your travel budget electronically.

The platform is ideal for those who prefer the security and convenience of a card over carrying large amounts of cash. You can exchange money within the app at a moment's notice, lock in a favourable rate before you travel, and spend like a local in over 40 currencies. While not a bureau de change for physical notes, it is a powerful tool for modern travellers.

Key Features and Services

Wise focuses on providing a seamless digital experience that puts transparency and fair pricing at the forefront. Its features are tailored for anyone who frequently interacts with multiple currencies.

- Mid-Market Exchange Rate: Wise uses the real exchange rate without adding a markup. Instead, it charges a small, transparent conversion fee that is clearly displayed before any transaction.

- Multi-Currency Account & Card: Hold and manage money in over 40 currencies in one account. The accompanying debit card allows you to spend directly in the local currency, avoiding hidden bank fees.

- Fee-Free ATM Withdrawals: You can withdraw up to £200 per month from ATMs abroad without any fees from Wise (some ATM operators may charge their own fee). A small fee applies to withdrawals above this limit.

- Intuitive Mobile App: The user-friendly app gives you complete control. You can convert funds, check balances, freeze your card, and review all transactions and fees in real-time.

Pros and Cons Analysis

Wise is a formidable option for digital currency management, but it's important to understand its specific use case compared to traditional cash-based services.

| Pros | Cons |

|---|---|

| Excellent Exchange Rates: Uses the mid-market rate, often beating banks. | Limited Free ATM Withdrawals: Fees apply after the £200 monthly limit. |

| Transparent Fees: All costs are shown upfront before you commit. | No Physical Cash Delivery: Not a service for ordering banknotes for home delivery. |

| Convenient for Spending Abroad: The card makes daily purchases simple. | Requires an ATM at Destination: You must withdraw cash upon arrival. |

Practical Tip: Before your trip, use the Wise app to convert your GBP into your destination’s currency. This locks in the exchange rate, so you know exactly how much you have to spend and can avoid any surprise fluctuations while you're away. It also helps you budget more effectively.

In summary, Wise is one of the best places to exchange foreign currency for digital use. It empowers travellers with the real exchange rate, transparent fees, and a powerful multi-currency card, making it an indispensable tool for cost-effective spending abroad. For those seeking the best currency exchange rates online, Wise's model is hard to beat for electronic transactions.

Website: https://wise.com/gb

6. Revolut (UK)

Revolut has revolutionised the digital banking space, offering a mobile-first solution for managing and exchanging money across borders. Its app-based multi-currency account is designed for users who prioritise speed, competitive rates, and in-app control over their finances. While it doesn't handle physical cash, it stands as one of the best places to exchange foreign currency digitally before and during your travels, offering rates close to the interbank standard on weekdays.

The platform's core strength lies in its seamless, instant currency exchange within the app. Users can hold and exchange over 30 currencies, making it an incredibly flexible tool for international travellers, remote workers, and anyone dealing with multiple currencies. Its tiered plans allow users to select a service level that matches their exchange frequency and volume.

Key Features and Services

Revolut provides a powerful suite of digital tools that put currency exchange control directly in your hands. This makes it a popular choice for those comfortable with managing their money entirely through a smartphone.

- Multi-Currency Account: Hold, send, and receive funds in over 30 fiat currencies directly from the app.

- Competitive Exchange Rates: Access exchange rates close to the interbank rate on weekdays, subject to fair-usage limits based on your plan.

- Instant In-App Exchange: Convert money between currencies in seconds, up to 200 times every 24 hours.

- Advanced Controls: Set up rate alerts to be notified when a currency hits your target price, or use the auto-exchange feature to automatically execute a trade when your desired rate is reached.

- Tiered Plans: Choose from a free standard plan with certain limits, or upgrade to paid tiers (Plus, Premium, Metal, Ultra) for higher fair-usage caps, lower fees, and additional travel perks like insurance and lounge access.

Pros and Cons Analysis

Revolut’s innovative approach offers significant advantages, but it's important to understand the associated conditions and limitations, especially regarding its fee structure.

| Pros | Cons |

|---|---|

| Excellent Weekday Rates: Highly competitive rates close to the market standard. | Weekend Markups: A markup is applied to exchanges made on weekends. |

| Fast & Convenient: Instant, app-based exchanges accessible anytime. | Fair-Usage Limits: Free plans have caps on commission-free exchanges per month. |

| Powerful In-App Tools: Rate alerts and auto-exchange provide great control. | Digital Only: Does not handle physical cash (notes or coins) for exchange. |

Practical Tip: To get the best value, plan your currency exchanges for weekdays (London time) to avoid the weekend markup. If you're a frequent traveller or exchange large sums, consider a paid plan to benefit from higher or unlimited fair-usage limits.

In summary, Revolut is a top-tier digital option for those looking to manage and exchange currency efficiently. Its user-friendly app and competitive weekday rates make it an outstanding tool for preparing your travel funds, though it is not a solution for exchanging leftover physical banknotes and coins post-trip.

Website: https://www.revolut.com

7. MoneySavingExpert (Travel money and card comparison hub)

As an independent UK consumer finance champion, MoneySavingExpert (MSE) doesn't directly sell currency but provides an invaluable service for anyone seeking the best deal. Its travel money hub is a research powerhouse, offering up-to-date guides and a powerful comparison tool to help you decide on the cheapest method- cash, card, or a combination- before you commit. This platform is ideal for savvy travellers who want to arm themselves with impartial data to find the best places to exchange foreign currency.

The site’s strength lies in its comprehensive, plain-English advice and its TravelMoneyMax tool. This feature scans dozens of online and high-street bureaux de change in real-time, presenting the best rates for home delivery or collection. It cuts through marketing jargon to show you exactly who is offering the most currency for your pound.

Key Features and Services

MSE's platform is designed to empower consumers with information, ensuring they make the most cost-effective decisions for their travel spending needs.

- TravelMoneyMax Comparison Tool: Instantly compares rates from numerous bureaux de change for both home delivery and in-person collection, finding the top deals available.

- Comprehensive Guides: Offers detailed, regularly updated advice on the pros and cons of using cash versus specialist travel credit or debit cards abroad.

- Practical Cost Comparisons: Provides clear, scenario-based examples that illustrate how much you could save by choosing the right method for your spending habits.

- Direct Provider Links: Once you find the best deal, MSE provides direct links to the provider’s website to complete your purchase or application, streamlining the process.

Pros and Cons Analysis

While MoneySavingExpert is a top-tier resource for research, it's important to understand its role as an informational hub rather than a direct provider.

| Pros | Cons |

|---|---|

| Independent & Trusted: Widely respected, impartial UK consumer advice. | Not a Direct Seller: You are redirected to third-party sites to buy currency. |

| Finds Cheapest Method: Helps you decide between cash, cards, or both. | Tool Downtime: The comparison tool can occasionally experience brief outages. |

| Actionable Comparisons: Provides direct links to the best-value providers. | Focus on Pre-Travel: Primarily geared towards buying currency, not selling it back. |

Practical Tip: Use the TravelMoneyMax tool a few days before you need your currency to compare both delivery and collection options. Sometimes the best rate is from an online provider offering delivery, but if you've left it late, the tool will pinpoint the best walk-in rate near you.

In summary, MoneySavingExpert is an essential first stop for anyone looking to exchange money. Its impartial tools and expert guidance ensure you're not just getting a good rate but are using the smartest method for your trip. For more insights on how these providers stack up, see our foreign currency exchange comparison.

Website: https://www.moneysavingexpert.com/travel/cheap-travel-money/

Top 7 Foreign Currency Exchange Comparison

| Service | Implementation complexity 🔄 | Resource requirements ⚡ | Expected outcomes 📊 | Ideal use cases 💡 | Key advantages ⭐ |

|---|---|---|---|---|---|

| We Buy All Currency | Low for user — pack & post; online wizard | Postal time; UK-centred payouts | Payment ~5 working days; quote-based value | 💡 Mixed/unsorted or obsolete currency holders, charities | ⭐ Accepts any currency/age; transparent quotes; free returns |

| Post Office Travel Money | Low — online order or branch collection | Branch visit or home delivery (fees under £500) | Immediate in-branch cash or delivered orders | 💡 Users wanting convenient high-street service | ⭐ Wide UK branch network; commission-free buyback with receipt |

| Tesco Travel Money | Low — online or in-store; Clubcard integration | Click & collect at stores; Clubcard for better rates | Next-day delivery in many areas; member discounts | 💡 Tesco shoppers and Clubcard members | ⭐ Member pricing; convenient store collection |

| Travelex UK | Moderate — multiple fulfilment options | Airport/retail collection; delivery fees for small orders | Fast airport pickup; optional buyback protection | 💡 Last-minute travellers needing airport cash | ⭐ Strong airport presence; flexible fulfilment options |

| Wise (formerly TransferWise) | Low — app/web-based conversions | No physical cash delivery; card/ATM withdrawals abroad | Mid-market FX with transparent fee; instant digital exchange | 💡 People prioritising best FX rates and card spending | ⭐ Mid-market rates; transparent fees; multi-currency account |

| Revolut (UK) | Low — app-first; plan-dependent features | In-app controls; fair-use limits on free tiers | Very fast weekday FX; weekend markups may apply | 💡 Mobile-first users who want fast exchanges and alerts | ⭐ Fast app experience; rate alerts; tiered plans |

| MoneySavingExpert (comparison hub) | Low — research and comparison tool | Requires user inputs; tool may intermittently downtime | Clarifies cheapest method; links to providers | 💡 Researching cash vs card and cheapest providers | ⭐ Independent, practical guidance; TravelMoneyMax scanner |

Ready to Exchange Your Foreign Currency the Easy Way?

Navigating the world of currency exchange can feel complex, but as we've explored, finding the best places to exchange foreign currency simply requires matching your needs to the right service. From high-street convenience to cutting-edge digital platforms, the ideal solution is out there. Your choice ultimately hinges on what type of currency you hold and what you want to achieve with it.

For straightforward exchanges of current, popular banknotes from a recent holiday, traditional providers like the Post Office and major supermarkets offer accessible, face-to-face service. If your goal is to hold and spend foreign currency digitally for future travels, fintech innovators such as Wise and Revolut provide exceptional rates and user-friendly mobile experiences. These are excellent choices for the modern, tech-savvy traveller preparing for their next adventure.

However, the real challenge for many households, businesses, and charities across the UK lies not with pristine banknotes, but with the forgotten collections of mixed foreign coins, the handful of old, obsolete notes from years gone by, and the jumble of leftover foreign currency that most services simply will not accept. This is where a specialist solution becomes invaluable.

Finding the Right Fit for Your Currency

To make the best decision, consider these key questions:

- What type of currency do you have? Is it a mix of current banknotes, a heavy bag of unsorted foreign coins, or a collection of old, out-of-circulation money? High-street banks and bureaux de change will typically only handle popular, current banknotes.

- How much time and effort can you spare? Do you have the time to sort through coins and notes, identify what is valuable, and visit multiple locations? Or do you need a fast, hassle-free process that handles everything for you with no need to sort coins?

- What is your primary goal? Are you looking to get spending money for an upcoming trip, or do you want to unlock the hidden value in a forgotten collection of currency? For individuals, this could mean extra cash; for charities and businesses, it represents a vital, untapped revenue stream.

The most important takeaway is that no currency should be considered worthless. That jar of coins on your shelf or the bag of mixed donations your organisation has received holds real, convertible value. While conventional options are suitable for conventional needs, the most comprehensive and effortless solution is one designed specifically to handle the currency that others leave behind.

For those with mixed, unsorted, or obsolete foreign coins and notes, the search for the best places to exchange foreign currency leads to a service built for precisely that purpose. A postal exchange service removes the burden of sorting and identification, providing a 100% guaranteed, secure, and straightforward way to convert every last coin and note into sterling. This approach is trusted by major UK charities, businesses, and individuals who need a reliable partner to manage their currency collections efficiently. Don't let that money gather dust; an easy, credible, and profitable solution is just a few clicks away.

Ready to finally cash in on that collection of leftover holiday money, foreign coins, and old banknotes? We Buy All Currency offers a fast, easy, and hassle-free postal service to convert your unsorted currency into cash, with a 100% guarantee. Trusted by major brands including charities, supermarkets, and police forces, we make it simple to exchange foreign coins and notes. Visit our website to see how simple it is to unlock the value in your currency today. We Buy All Currency