UK Charity Donation Tax Deduction Guide

Posted by: Ian Stainton • 20 Sep 2025

When you donate to a UK charity, your generosity can be supercharged through a brilliant little scheme called Gift Aid. It's a simple but powerful way for registered charities to claim an extra 25p from the government for every £1 you donate. The best part? It doesn’t cost you a single penny more. It’s not about reducing your own tax bill, but about making your donation go much, much further.

Unlocking the Power of Your Donations

A lot of people think that getting a tax deduction on a charity donation is some complicated affair, something only for big-time philanthropists. But the reality is far simpler and accessible to everyone. The whole system is designed to encourage giving by making every pound work harder for the causes you believe in.

Think of it as a team effort between you, your chosen charity, and the government. You make the gift, and the government tops it up with a bonus. This bonus is effectively a refund of the basic rate tax you've already paid on that money, redirecting it straight to the charity.

How Gift Aid Works

The process is wonderfully straightforward. When you donate, the charity will ask you to make a Gift Aid declaration. This is just a simple form or a checkbox confirming you’re a UK taxpayer and you’re happy for them to claim the tax back.

Once you’ve ticked that box, the charity can claim 25p for every £1 you give. Why 25p? It’s based on the 20% basic rate of income tax. The logic is that to donate £1, you had to earn £1.25 and pay 25p in tax. Gift Aid lets the charity reclaim that 25p.

This one simple step increases the value of your donation by a massive 25%. A £100 donation instantly becomes £125 for the charity—a huge boost that helps them continue their vital work.

Beyond Cash Donations: Turning Leftover Foreign Currency into a Maximised Gift

This incredible benefit isn't just for cash gifts. It also applies when charities sell donated goods and, crucially, when they convert other assets—like that jar of leftover foreign currency from your holidays. This is where a specialist service like ours becomes essential.

So many of us have old, obsolete, or leftover foreign currency collecting dust in a drawer. We offer a fast, easy, and completely hassle-free way to exchange foreign coins and notes, turning them into a valuable sterling donation ready for Gift Aid. This is a practical, real-world insight into making the most of what you already have.

- No Sorting Needed: Don't waste time separating currencies or counting coins. Our service is built for total convenience. Simply send us all your leftover holiday money.

- 100% Guaranteed: We promise a fast, transparent, and efficient process, giving you a clear valuation for your currency.

- Trusted by Major Brands: Our trust and credibility are proven by our partnerships. We are trusted by major UK charities, supermarkets, airports, and even police forces to handle their currency collections securely.

By using our service to donate foreign coins to charity, you transform forgotten money into a maximised, Gift-Aid-eligible contribution. We manage the entire conversion, providing the charity with the exact sterling amount they need to make a successful claim. It’s the easiest way to ensure your leftover holiday money makes the biggest possible difference.

And for higher-rate taxpayers, the news gets even better. Not only does the charity get the 25% boost, but you can personally claim back the difference between the basic rate and your higher tax rate. It makes giving even more rewarding.

Ultimately, understanding the charity donation tax deduction system empowers you to make your generosity go further. With our help, even the smallest amount of leftover holiday money can become a significant force for good. To learn how to convert foreign coins and banknotes into a powerful charitable gift, visit our homepage.

Who Qualifies for Gift Aid and Tax Relief

When it comes to getting a charity donation tax deduction, the magic happens through Gift Aid. But for it to work, both you and the charity you're supporting need to meet a few criteria set by HMRC. It’s essentially a partnership designed to make sure every donation goes as far as possible.

Think of it this way: when you pay tax, you're building up a sort of 'credit' with the government. To qualify for Gift Aid, you just need to have paid enough Income or Capital Gains Tax during the tax year to cover the 25% that the charity will reclaim on your donations. It’s the single most important rule for donors.

This rule exists to ensure the extra money 'gifted' back to the charity genuinely comes from tax you've already paid. So, if you donate £100 to various charities in one year, you need to have paid at least £25 in tax to cover the Gift Aid claim.

The Donor Eligibility Checklist

So, what does that mean for you in practice? To give your donations that extra boost with Gift Aid, a few simple conditions need to be met. These helpful tips apply whether you're donating cash, selling goods for a charity, or looking to donate foreign coins to charity.

- You must be a UK taxpayer. This is the starting point. The scheme is a UK government initiative to support charitable giving through the tax system.

- You must pay enough tax. The total Income Tax and/or Capital Gains Tax you've paid in a tax year (6th April to 5th April) has to be at least equal to the Gift Aid all charities will reclaim on your donations for that year.

- You must make a Gift Aid declaration. This is basically your permission slip. It's a simple statement you give to the charity confirming you're a taxpayer and that you want them to claim Gift Aid.

It's worth remembering that Council Tax and VAT don't count towards this. The system is specifically linked to your personal income and capital gains taxes. Keeping a rough tally of your donations can help you be sure you've got enough 'tax credit' to cover the claims.

The Charity’s Role and Responsibilities

Of course, the charity has a vital part to play, too. Not just any organisation can claim Gift Aid; they have to be officially recognised and registered to do so. This is a crucial safeguard to ensure the system supports genuine, legitimate causes.

To qualify, a charity must be registered with the Charity Commission for England and Wales, the Scottish Charity Regulator (OSCR), or the Charity Commission for Northern Ireland. Community Amateur Sports Clubs (CASCs) that are registered with HMRC can also claim Gift Aid.

This is where our trusted service really helps. We partner directly with major UK charities, supermarkets, airports, and even police forces, who all trust us with their foreign currency collections. When you exchange foreign coins through us for a charity, the process is fast, simple, and completely hassle-free.

We manage the entire conversion of your leftover foreign currency without you needing to sort a single coin. Our 100% guaranteed service provides the charity with a clear, documented sterling donation, which makes their Gift Aid claim straightforward and accurate. Your generosity gets fully amplified. For more details on how to convert foreign coins and banknotes into impactful donations, visit our homepage.

How to Claim Tax Relief on Your Donations

Figuring out tax relief on your charitable donations often sounds more complicated than it actually is. For most people, it all comes down to one simple action: ticking the Gift Aid declaration box. That little tick is all it takes to authorise the charity to claim an extra 25% on top of your donation, straight from the government.

But what if you pay tax at the higher or additional rate? Well, there's an extra benefit waiting for you personally. You can actually claim back the difference between the tax you've paid and the basic rate the charity reclaims. Let's break down how that works with some helpful advice.

The Standard Process for Basic Rate Taxpayers

For the vast majority of UK taxpayers, the charity does all the heavy lifting. Your only job is to make a Gift Aid declaration. This is simply a statement confirming you're a UK taxpayer and you’re happy for the charity to reclaim the tax on your donation. It really is that easy.

Once you’ve ticked that box, your part is done. The charity then uses your declaration to claim back 25p for every £1 you give. This is the heart of the UK's charity donation tax deduction system—it’s designed to be simple for the donor and effective for the charity.

This is where our service really helps when you want to exchange foreign coins and notes for a good cause. We manage the whole conversion process. Our fast, easy, and 100% guaranteed service gives the charity a clear sterling amount and all the paperwork they need, making their Gift Aid claim completely straightforward.

An Extra Benefit for Higher Rate Taxpayers

If you’re a higher rate (40%) or additional rate (45%) taxpayer, you can get a little something back for yourself. You're able to claim the difference between your tax rate and the basic 20% rate. This is a personal tax benefit, so the money is returned directly to you.

Let’s look at a quick real-world example:

- You donate £100 to your favourite charity.

- The charity claims Gift Aid, boosting your donation to £125.

- Because you're a 40% taxpayer, you can personally claim back 20% of the gross donation (£125 x 20%), which works out to be £25.

- Suddenly, your generous £100 donation has only cost you £75.

It's a fantastic incentive that makes your generosity go even further.

How to Make Your Claim with HMRC

Getting this extra relief back is pretty simple and usually done in one of two ways. Which one you choose just depends on your own situation.

- Through a Self Assessment Tax Return: If you already complete a tax return, this is the most direct route. There’s a dedicated section on the form to list all your Gift Aid donations. HMRC then crunches the numbers and adjusts your tax bill.

- By Contacting HMRC: Don't fill out a tax return? No problem. Just get in touch with HMRC and ask them to adjust your tax code. You can do this over the phone or via your online government gateway account. They'll factor in your donations, meaning you pay less tax over the course of the year.

The whole system is built to be user-friendly. In fact, tax reliefs are a massive driver of charitable giving in the UK. In the tax year ending April 2023, reliefs for charities and their donors hit nearly £6 billion—an 8% jump from the year before. It just goes to show how much these mechanisms matter. If you want to dive deeper, you can explore a detailed guide to UK tax relief on charitable donations to see the full picture.

How to Donate Foreign Coins and Obsolete Currency

That forgotten jar of holiday money sitting in a drawer holds far more potential than you might realise. So many of us come back from trips abroad with a handful of foreign coins and notes, only to shove them in a drawer and forget about them. But what if that spare change could become a powerful, impactful donation to a good cause?

The biggest hurdle is simply not knowing what to do with it. Your local bank and high street exchange bureaus won’t touch foreign coins, and most charity shops just aren’t set up to handle them. This is where our specialist service comes in. We make the entire process fast, easy, and completely hassle-free.

Best of all, you don't even need to sort through everything. Just gather up all your leftover foreign currency, and we'll take it from there.

Turning Clutter into a Real Contribution

Our service is designed to be as convenient and effective as possible. We convert foreign coins and banknotes—even old or obsolete currency that's no longer in circulation—into valuable sterling that charities can put to use right away. This simple conversion unlocks the full potential of your donation, making it eligible for a Gift Aid claim, a crucial part of the UK's charity donation tax deduction system.

Getting started couldn't be easier with these practical tips:

- Gather Your Currency: Collect all your leftover holiday money, old foreign coins, and obsolete banknotes. No sorting or counting is necessary.

- Send It To Us: Pop your currency in a package and send it to us using our straightforward postal service.

- We Handle Everything: Our experts will sort, count, and value the entire collection, giving you a clear and transparent valuation.

Once that's done, we transfer the final sterling amount directly to your chosen charity, along with all the paperwork they need to make their Gift Aid claim. It’s a brilliant way to turn what feels like a small gesture into a much larger contribution.

The table below shows the simple journey your unused foreign currency takes, and how our service adds value at every step, benefiting both you and the charity.

From Leftover Currency to Maximised Charitable Donation

| Stage | Your Action | Our Hassle-Free Service | Benefit to You and the Charity |

|---|---|---|---|

| 1. Collection | Gather all your old foreign coins & notes. | You send them to us, unsorted. | No need for you to sort or count anything. |

| 2. Valuation | — | We professionally sort, count & value everything. | A clear, official valuation is created for tax purposes. |

| 3. Conversion | — | We convert the full amount into usable sterling. | Turns unusable currency into valuable funds for the charity. |

| 4. Donation | Choose your charity. | We send the money directly to them. | The donation gets to the cause quickly and efficiently. |

| 5. Gift Aid | Sign a Gift Aid declaration. | We provide the charity with necessary documents. | The charity can claim an extra 25% on your donation. |

By managing the entire process, we ensure your donation's impact is maximised with minimal effort on your part.

The Valuation Process and Tax Benefits

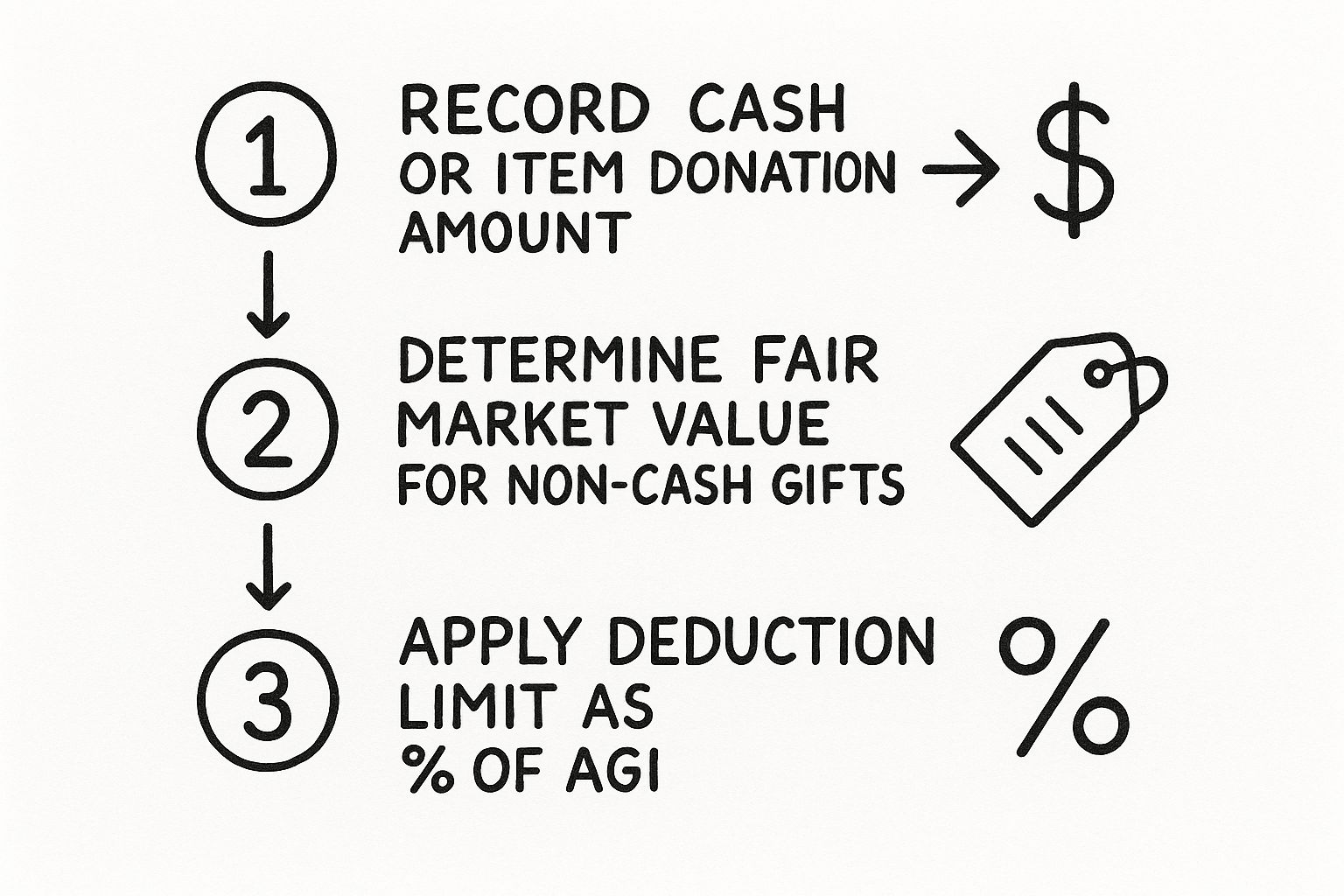

Valuing a mixed bag of international currency can get complicated, but our system is built for accuracy and transparency. We determine the fair market value of your coins and notes at the time we process them, and this final sterling total becomes the official donation amount.

This figure is absolutely vital because it’s what the charity uses for its Gift Aid claim. A clear, documented valuation ensures the charity can successfully reclaim that extra 25% from the government, directly linking this unique kind of non-cash giving to powerful tax benefits. This is exactly what our service facilitates for you.

This visual guide shows the key stages of turning a non-cash gift into a valid tax deduction, from recording the donation to applying official limits—a process we handle from start to finish.

A Trusted Partner for Major UK Organisations

We’re incredibly proud to be a trusted partner for some of the biggest names across the UK, including leading charities, supermarkets, airports, and even police forces. These organisations depend on our 100% guaranteed service to handle their currency collections securely and efficiently.

When you choose to use our service, you are using the same reliable process trusted by household names. We turn what is often a logistical nightmare for charities into a streamlined source of income, ensuring more of your donation goes directly to the cause.

Our expertise means charities don't have to waste their own precious time and resources trying to convert foreign coins and banknotes. We provide a specialist solution that maximises the return while slashing the administrative burden. To find out more about how you can donate foreign coins to charity and make a genuine difference, have a look at our dedicated charity page.

Ultimately, our fast and easy service bridges the gap between your forgotten currency and the charities that desperately need it. We take all the hassle out of donating, making it simple for you to support the causes you care about while helping them benefit from every single penny—including that crucial Gift Aid boost.

Other Ways to Maximise Your Charitable Giving

While Gift Aid is a fantastic way to boost your donations, it’s really just the start. If you want to make your generosity work even harder, there are several other smart strategies that can seriously increase the impact of your giving.

These methods offer powerful tax benefits for you and, more importantly, deliver much-needed funds to the causes you care about. From regular workplace donations to more substantial gifts of assets, there are plenty of avenues to explore.

Payroll Giving: A Simple and Effective Method

One of the most efficient ways to give is through Payroll Giving, often known as ‘Give As You Earn’. It’s brilliant in its simplicity. You donate to your favourite charity directly from your gross pay, before the tax is taken off.

This means you get immediate tax relief on your donation, making it an incredibly cost-effective way to support a cause. For example, if you’re a basic-rate taxpayer and donate £10 through Payroll Giving, it only costs you £8 from your take-home pay. For a higher-rate taxpayer, that same £10 donation costs just £6. It’s an automated, hassle-free way to provide steady support without any extra paperwork.

High-Impact Giving: Donating Shares and Property

For those looking to make a more substantial contribution, donating shares, securities, or property can be a game-changer. This form of giving comes with significant tax advantages, often making it more beneficial than selling the assets yourself and then donating the cash.

When you donate qualifying assets to a charity, you can claim full Income Tax relief on their market value. Better yet, you won't have to pay any Capital Gains Tax on them either. This double benefit can make a huge difference, allowing you to give more while also managing your personal tax liabilities.

These high-impact methods are vital for the charity sector. Tax reliefs play a massive role in funding charitable work in the UK. In the tax year ending April 2025, reliefs for charities and their donors were estimated at around £6.7 billion—a figure that shows just how crucial this support system is. You can learn more about the latest trends in charitable donations and tax relief.

Our Role in the Charitable Ecosystem

So, where do we fit into this picture? Beyond individual giving strategies, our service plays a crucial role in this wider ecosystem. We're the essential link that turns otherwise unusable currency into vital funds for good causes.

Think about large-scale fundraising drives, like those organised by police forces or airports. They often end up with a huge amount of leftover foreign currency.

These organisations trust our 100% guaranteed service to convert those mixed bags of foreign coins and notes into usable sterling. We provide a fast, easy, and hassle-free solution, ensuring that every penny and cent of donated currency is accounted for and maximised for the charity.

We take the logistical headache away from these organisations. This allows them to focus on their mission while we handle the specialist task to exchange foreign coins and notes. This partnership shows not just our reliability, but our integral role in turning public generosity into tangible support. If your organisation is looking for new fundraising avenues, you can find some great inspiration in our guide to effective charity fundraising ideas.

By offering a dependable way to donate foreign coins to charity, we ensure that no donation, no matter how small or unusual, goes to waste. We're proud to be the trusted partner that helps convert these collections into meaningful contributions, ready to be amplified by schemes like Gift Aid. To see how simple it is to get started, visit our homepage.

Common Questions About Donations and Tax

Navigating the world of charitable giving and tax can throw up a few questions. To help you give with complete confidence, we’ve put together clear, practical answers to some of the most common queries we hear. This section reinforces the key takeaways from this guide, making sure you understand every aspect of your charity donation tax deduction.

From handling Gift Aid declarations to understanding how your leftover foreign currency becomes a valuable donation, these answers are designed to be direct and helpful. We want you to feel fully empowered to make your generosity count.

What if I Stop Paying Tax But Have an Active Gift Aid Declaration?

This is a crucial point to get right. If your circumstances change and you no longer pay enough UK tax to cover the Gift Aid on your donations, you must let the charity know and cancel your declaration. It’s that simple.

If a charity claims Gift Aid on your donation but you haven't paid enough Income or Capital Gains Tax to cover that amount, HMRC will ask you to pay the difference. Keeping charities updated is a vital step that helps you avoid any unexpected bills and ensures the system works as intended for everyone.

Can I Claim Gift Aid if I Donate Foreign Coins at a Charity Shop?

While charity shops are grateful for every donation, handling foreign currency can be a real headache for them. Most shops just don't have the specialist processes needed to exchange foreign coins for the best rate, which can delay or complicate their Gift Aid claim.

This is exactly where our service comes in. Our fast and easy process is built specifically to solve this problem. We provide a 100% guaranteed exchange rate and a streamlined service that ensures the charity receives the maximum sterling value promptly. This clarity and efficiency make their Gift Aid claim straightforward, boosting the impact of your donation.

How Do I Value My Foreign Coin Donation for My Tax Records?

You don’t have to—our hassle-free service does all the legwork for you. All you need to do is gather your unsorted leftover foreign currency and send it our way. There's absolutely no need to sort coins.

We handle all the counting, sorting, and valuation. Once everything is processed, we provide both you and your chosen charity with a clear, detailed statement showing the final value in pounds sterling (£). This document gives you the official figure you need for your Gift Aid declaration and, if you’re a higher-rate taxpayer, for your Self Assessment tax return. We take all the complexity out of the process.

Are There Hidden Fees When Exchanging Foreign Currency for Charity?

Our process is completely transparent, which is why we’re trusted by major brands like charities, supermarkets, airports, and police forces. We agree on any commission or processing charges directly with our charity partners beforehand, so there are absolutely no surprises for you as the donor.

Because we are a specialist service handling large volumes of currency, our efficiency and competitive rates often result in a higher net donation reaching the charity than if they tried to manage the exchange themselves. This means more of your money goes directly to supporting the cause you care about.

Is My Old Pre-Euro Currency Worth Anything?

Yes, absolutely! So many people have old European currencies like German Deutschmarks, French Francs, or Spanish Pesetas tucked away in a drawer. While you can't spend them in shops anymore, they often still hold value and can be converted into a charitable donation.

Our service specialises in exchanging these old and obsolete currencies. Don't just assume they're worthless; send them to us along with your other foreign coins and notes. We can convert foreign coins and banknotes from decades ago into valuable funds for today’s charities. It’s a fantastic way to unlock hidden value in money that would otherwise be forgotten.

How Do I Know My Donation Reached the Charity?

Trust and credibility are at the heart of everything we do. When you use our service, the entire process is fully documented. After we exchange foreign coins and notes, we provide a clear statement detailing the final sterling amount.

The funds are transferred directly to the charity, and you receive confirmation of the valuation. This transparent process gives you complete peace of mind, knowing your donation has been successfully processed and delivered. Many people wonder where to donate foreign coins, and using a trusted service ensures your contribution is secure and effective. For more guidance, you can learn about the best places to donate your foreign coins to charity in our helpful guide.

At We Buy All Currency, our mission is to make charitable giving as simple and impactful as possible. Our fast, easy, and hassle-free service turns your forgotten foreign currency into vital funds for the causes that matter most. With our 100% guaranteed process, trusted by major UK organisations, you can be sure your donation is in safe hands.

Ready to turn your leftover holiday money into a powerful donation? Visit us at https://www.webuyallcurrency.com to learn more and get started today.