A Practical Guide: How to Compare Currency Exchange Rates in the UK

Posted by: Ian Stainton • 24 Nov 2025

When you need to compare currency exchange rates in the UK, the advertised number is only half the story. To find the genuine best deal, you have to look past the headline rate and figure out the total sterling you’ll actually receive after all the hidden costs are factored in.

The best value comes from a provider who offers a competitive rate combined with low—or even zero—commission. That's how you ensure more money ends up back in your pocket.

How to Compare UK Currency Exchange Rates Effectively

Finding the true value when you exchange foreign coins and notes isn't always as simple as it should be. Plenty of providers will tempt you with an attractive rate, only to bury extra costs in commission fees or unappealing spreads. Before you know it, you’re left with far less cash than you expected.

The secret is to understand your options and know exactly what to look for. In this guide, we'll break down the main types of currency exchange providers in the UK, from your local high street bank to specialist online services. We’ll show you how to spot the real cost of any transaction and provide practical tips, so you can make a smart choice every time you convert foreign coins and banknotes.

Where to Exchange Your Currency

Your choice of provider makes a huge difference to your final payout. Banks might seem convenient, but online services often deliver much more competitive rates. The problem is, most of them share a critical weakness: they flat-out refuse to take foreign coins or old, out-of-circulation notes.

This is where a dedicated service like ours becomes invaluable. We designed our platform to be fast, easy, and hassle-free, offering a 100% guaranteed way to exchange leftover foreign currency that everyone else turns away. You don’t even have to sort through your coins.

We are the trusted choice for major UK brands—including charities, supermarkets, airports, and even police forces—to handle all their foreign currency needs with professional care.

To help you get a clearer picture, the table below gives a quick overview of what you can expect from different types of providers.

Comparing UK Currency Exchange Provider Options

This table summarises the main currency exchange options available in the UK, highlighting their typical features, fees, and what they’re best suited for.

| Provider Type | Typical Rate Spread | Common Fees | Accepts Coins & Old Notes? | Best For |

|---|---|---|---|---|

| High Street Banks | Moderate to High | Transaction fees | No | Existing customers exchanging major banknotes |

| Post Office | Moderate | Often commission-free | No | Convenient, in-person banknote exchange |

| Airport Kiosks | Very High | Commission & fees | No | Last-minute, emergency currency needs only |

| Specialist Online Services | Low to Moderate | Minimal to None | Yes (Specialised) | Best overall value, especially for coins & old notes |

As you can see, for everyday banknote exchanges, you have a few options. But when it comes to the leftover coins and old notes that most places reject, a specialised service is the only way to unlock their value.

Thinking critically about rates and fees isn't just for currency exchange. Applying similar comparison strategies for financial products like travel insurance can make a big difference to your overall holiday budget. By taking a closer look at all your travel-related financial decisions, you can ensure you’re getting the best possible value, whether you're exchanging leftover coins or getting the right cover for your trip.

Understanding the True Cost of Currency Exchange

When you’re comparing currency exchange rates here in the UK, the number you see on the board is only half the story. To figure out what you’ll actually get back in your pocket, you need to dig a little deeper and understand the hidden costs that can eat into your money.

The starting point for any fair comparison is the mid-market rate. Think of this as the ‘real’ exchange rate – it’s what banks and big financial institutions use when they trade currencies with each other. It’s the purest rate you can find, with no profit margin built in, making it the perfect benchmark to judge everyone else against.

Beyond the Advertised Rate

Of course, no high street provider or online service will offer you the mid-market rate. Their profit comes from the gap between that real rate and the one they give you. This gap is known as the exchange rate spread.

A wider spread simply means the provider is taking a bigger slice of your money. This is why a place advertising a fantastic-looking rate can sometimes end up being more expensive than one with a less appealing rate but a much tighter spread. For a full breakdown of how these rates work, check out our guide on understanding currency exchange rates.

Uncovering Hidden Fees and Commissions

On top of the spread, many providers tack on extra charges that can seriously shrink your final payout. These usually pop up as commission fees or flat service charges.

- Commission Fees: Some providers charge a percentage of the total amount you’re exchanging. This can get quite pricey if you’re dealing with larger sums.

- Fixed Service Fees: Others apply a flat fee, no matter how much you’re changing. This makes exchanging small amounts particularly poor value for money.

The only way to get a true like-for-like comparison is to ask for a final quote showing the exact amount of sterling you will receive after all charges have been taken off.

The best way to compare is to ignore the advertised rate and ask a simple question: "If I give you 100 US dollars, how many pounds will I get back after all your fees?" The highest number wins. Simple as that.

The currency market is always on the move, which adds another layer of complexity. The British pound (GBP), for instance, saw significant swings against the US dollar (USD) throughout 2025, which really highlights the dynamic nature of UK currency exchange rates. The rate peaked at 1.3726 USD on June 26, 2025, before dropping back to 1.314383 USD by November 19, 2025, showing just how sensitive it is to global economic shifts.

Calculating the Total Cost of Your Exchange

Let's walk through a quick example. Imagine you have €500 to exchange. Provider A is offering a rate of £0.85 per euro with no fees. Provider B has a better-sounding rate of £0.86 but charges a £10 service fee.

- Provider A: €500 x 0.85 = £425

- Provider B: (€500 x 0.86) – £10 = £430 – £10 = £420

In this real-world scenario, Provider A’s seemingly worse rate actually puts more money back in your wallet. This simple bit of maths shows why looking at the whole picture is so important. To really get a grip on the overall cost, it's also worth looking into smart banking strategies to avoid international fees that can often be buried in transactions.

This becomes even more critical when you need to exchange foreign coins and notes, especially that leftover currency from a trip. Most places won’t even touch them, making their 'rate' effectively zero. That’s where we’re different. We offer a fast, easy, and hassle-free way to convert your foreign coins and banknotes, with a 100% guarantee on our transparent rates, ensuring you get real value from currency others have written off.

A Detailed Comparison of UK Exchange Providers

When you need to compare currency exchange rates in the UK, the provider you choose makes all the difference. It’s not just about the rate you see advertised; it’s about the total cost, convenience, and what they’re actually willing to accept. Getting this right is the key to getting the most back for your foreign currency.

Let’s walk through the main options you'll find in the UK: your high street bank, the Post Office, those airport kiosks, and specialist online services. We’ll look at them from a practical point of view—what they really cost, how easy they are to use, and crucially, whether they’ll take that jar of mixed coins and old notes you’ve got stashed away.

High Street Banks

Going to your own bank—like Lloyds, Barclays, or HSBC—can feel like the safest bet. It's a familiar name, and you already have a relationship with them. But that comfort often comes with a hidden price tag.

Frankly, banks just don't offer very good exchange rates. Their spreads are typically wider, meaning they keep a bigger slice of the pie for themselves. Even if they offer a "fee-free" exchange for customers, a poor rate can easily wipe out any of those savings.

But the biggest drawback? They are incredibly picky. High street banks will almost never exchange foreign coins. It’s just not worth their time or effort to sort, count, and ship them. The same goes for any old or obsolete banknotes you might have from years ago—they simply won’t touch them.

Key Takeaway: Banks are okay if you're an existing customer exchanging a clean stack of common banknotes in person. For anything else, especially leftover coins or old notes, they're a dead end.

The Post Office

With a branch on nearly every high street, the Post Office has become a go-to for currency exchange. It’s undeniably convenient for face-to-face transactions and often promotes commission-free services. That sounds great on the surface, but you have to look closer at the rate you’re actually getting.

While the Post Office is usually a step up from the airport kiosks, their rates often can't compete with online specialists. Running thousands of physical locations costs a lot of money, and that cost is quietly built into the exchange rate spread.

And just like the banks, the Post Office has its limits. They will only convert foreign coins and banknotes that are currently in circulation. If you turn up with a bag of mixed foreign coins or find some old Spanish pesetas in a drawer, you’ll be politely turned away.

Airport Bureaux de Change

Airport exchange kiosks are the definition of a last-resort option. They offer maximum convenience for travellers in a rush but deliver shockingly poor value. They know they have a captive audience, and their rates and fees reflect that.

The spreads at airport bureaux de change can be massive, sometimes eating up 10-15% of your money's value before you even get on the plane. You’ll often see "0% commission" advertised in big letters, but that’s a classic bit of marketing misdirection to distract you from the terrible rate.

Unsurprisingly, their acceptance policies are just as rigid as the banks. They’re set up for one thing: quickly exchanging major, current banknotes. Don’t even think about trying to exchange foreign coins and notes that are old or mixed. Their business is built on speed, not on handling the kind of currency most of us have left over after a trip.

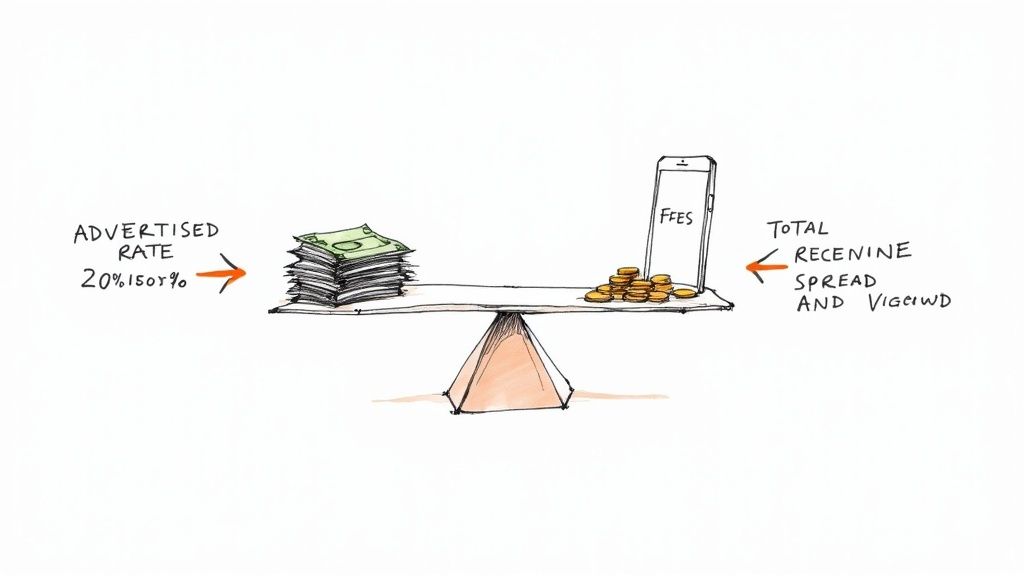

This image breaks down how the costs add up.

It’s a simple visual, but it makes a crucial point: the true cost is always the provider's spread on top of the mid-market rate, plus any other sneaky fees they add on.

Specialist Online Services Like Ours

This is where the game changes. Specialist online currency services offer a modern, efficient, and much more cost-effective way to exchange your money. By operating online, we cut out the massive overheads of high street branches and pass those savings straight to you with better rates.

For a more granular look at how providers compare, our currency exchange comparison UK guide goes into even more detail.

But more importantly, a dedicated online service like ours is built to solve the exact problems that traditional providers won't touch. We know that leftover foreign currency is usually a mix of coins and old notes. That’s why we’ve built a process that is fast, easy, and hassle-free to handle exactly that.

Here’s what sets us apart:

- We Take Almost Everything: We specialise in exchanging the foreign coins, leftover holiday cash, and old, obsolete currency that banks and bureaux de change refuse.

- No Sorting Required: Life's too short to spend hours sorting through coins. Our service is designed so you don't have to. Just send them to us, and we'll do the work.

- A Service You Can Trust: We give you clear, transparent rates upfront and offer a 100% guarantee on our service, so you have complete peace of mind.

We’re proud to be a trusted partner for major UK organisations, including well-known charities, supermarkets, airports, and even police forces. They rely on us to professionally handle their currency needs. Whether you want to clear out that forgotten jar of change or donate foreign coins to charity, we provide the perfect solution.

To make things even clearer, here’s a table that sums up your options at a glance.

In-Depth Look at UK Currency Exchange Services

This table offers a practical comparison of the different providers, focusing on what really matters: total cost, convenience, and whether they’ll accept your odds and ends.

| Provider | Average Total Cost (Rate + Fees) | Convenience Factor | Exchanges Foreign Coins? | Exchanges Old/Obsolete Notes? | Situational Recommendation |

|---|---|---|---|---|---|

| High Street Bank | High | High (for existing customers) | No | No | Only for exchanging clean, current banknotes in person if you're already a customer. |

| The Post Office | Medium-High | Very High (many locations) | No | No | A convenient high street option for standard, current banknotes, but rates aren't the best. |

| Airport Bureau | Very High | High (at the airport) | No | No | An absolute last resort for emergency cash needs right before a flight. Avoid if possible. |

| We Buy All Currency | Low | High (online/postal service) | Yes | Yes | The best choice for getting value from leftover foreign coins, old notes, and mixed currency. |

As you can see, for anything beyond simple, current banknotes, the traditional options just don't stack up. They aren't built to handle the reality of leftover travel money.

Unlocking Value from Leftover Foreign Currency

We’ve all been there. You get home from a trip, unpack your bags, and find a random collection of foreign coins and notes you’d completely forgotten about. Most of us just chuck it in a drawer, assuming it's now worthless and destined to become a dusty souvenir. But what if that forgotten currency could easily be turned back into pounds?

This is the exact problem we solve. We’ll get into why high street banks and bureaux de change almost always refuse to exchange foreign coins and show you how our specialist service makes getting your money back simple, valuable, and completely hassle-free. You might be shocked at how much value is hiding in that pile of loose change.

Why Banks and Bureaux de Change Say No to Coins

The reason you can't just walk into your local bank and swap a handful of euro or dollar coins is purely down to economics. For big financial institutions, dealing with coins is a logistical nightmare.

Unlike banknotes, which are easy to stack and process, coins are heavy, bulky, and come in all sorts of denominations from across the globe. The cost of sorting, counting, verifying, and shipping them back to their home country is just too high. It would actually cost them more to handle your coins than the coins are worth, so they simply don’t bother.

This leaves holidaymakers with a common problem but no obvious way to solve it. That leftover foreign cash feels like wasted money, but the high street offers no way of getting it back.

When you try to exchange foreign coins, high street providers see a high-cost, low-value transaction. Our service, however, is built specifically to handle this challenge, making it fast, easy, and worthwhile for you.

This is exactly where we come in. We’ve built a process designed to efficiently handle what others won’t, so you can convert foreign coins and banknotes without any fuss.

The Hassle-Free Way to Exchange Leftover Currency

We believe getting cash back from your leftover holiday money should be dead simple. Our entire service is built around a straightforward, 100% guaranteed process that works for you. We make it easy to convert foreign coins and banknotes that would otherwise be rejected everywhere else.

Here’s what makes our approach different:

- No Sorting Needed: Don't waste your time separating different currencies. Just scoop up all your leftover coins and notes, and we’ll do all the hard work.

- All-in-One Service: We accept a massive range of currencies, including current coins, old notes, and even obsolete, out-of-circulation money.

- Trusted by Major Brands: We’re proud to be trusted by major UK organisations, including well-known charities, supermarkets, airports, and even police forces who rely on us for their currency exchange needs.

It’s also useful to know where the official rates come from. In the UK, currency exchange rates are set by market forces, with benchmarks published by official sources. The Bank of England, for instance, publishes daily spot rates which are a reliable reference point, while HM Revenue & Customs (HMRC) provides its own approved rates for tax purposes. You can see the latest figures by checking the exchange rate data from the Bank of England.

A Second Life for Your Loose Change

Besides putting money back in your pocket, there's another great way to use that leftover currency. Many of our customers choose to donate foreign coins to charity, turning small amounts of forgotten change into genuinely meaningful contributions.

Our platform makes this incredibly easy. You can send your currency to us and simply choose to have the exchanged value sent directly to one of our trusted charity partners. It’s a fast, simple way to support a good cause, making sure every last coin from your travels makes a real difference.

Your Checklist for Getting the Best Exchange Rate

Trying to figure out currency exchange can feel like a maze, but getting a great deal is actually quite straightforward. If you follow a few simple steps, you can confidently compare exchange rates in the UK and make sure you're getting the most sterling back for your foreign currency.

Think of this as your practical guide to cutting through the marketing fluff and focusing on what really counts: the final amount that lands in your pocket.

1. Start with a Benchmark

Before you even look at what a provider is offering, find out the mid-market rate. This is the genuine exchange rate banks use when trading with each other, and you can find it in seconds on Google or any major financial news site. Knowing this number gives you a solid benchmark to judge just how good (or bad) any quote really is.

2. Calculate the True Cost

An amazing advertised rate means nothing if it gets eaten up by hidden fees and commissions. The single most important thing you can do is work out the total cost of the transaction.

- Always ask for a final quote showing the exact amount of pounds you will receive after all charges.

- Compare this final figure between different services, not their headline rates.

- Don't forget to factor in any delivery or service fees that might be tacked on at the end.

This simple approach exposes the real value of the deal and helps you avoid any nasty surprises. For a deeper look at finding the best currency exchange rates online, our detailed guide offers even more tips.

3. Weigh Up Convenience and Speed

While the rate is obviously key, don't forget to ask yourself how much your time is worth. Sometimes, a slightly less competitive rate is a price worth paying if the service is significantly easier or quicker. For many people, a fast, easy, and hassle-free experience is just as important as the final payout.

4. Separate Your Currency Types

This is the step most people miss, and it can make a big difference. To get the best overall value, it’s smart to separate your standard, current banknotes from any leftover foreign coins and old, obsolete notes you might have. High street providers like banks and the Post Office will only take the clean banknotes, leaving you stuck with the rest.

By separating your currency, you can use the right service for the right job. Use a standard provider for your clean banknotes, and a specialist for everything else they reject.

5. Use a Trusted Specialist for Coins and Old Notes

For all the currency that everyone else turns away, you need a specialist. This is where a trusted service like ours is essential. We are experts in dealing with the leftover foreign currency that others simply won't touch.

Our 100% guaranteed service is designed to exchange foreign coins and notes with zero fuss. You don't even need to sort through it yourself. We're trusted by major UK brands—including charities, supermarkets, airports, and even police forces—to handle their currency needs professionally. Whether you want to finally convert that forgotten jar of change or donate foreign coins to charity, we offer a simple, reliable solution.

When you start looking at currency exchange rates in the UK, it quickly becomes clear that not all services are the same. After you’ve done your comparisons, the final choice really boils down to three things: trust, convenience, and whether you're getting genuine value for your money.

We get it. Exchanging currency, especially when it’s leftover coins and old notes, can feel like a real chore. That’s why we’ve built a service that’s designed around you, making the whole process fast, easy, and completely hassle-free. We back our service with a 100% guarantee, so you have total peace of mind from the moment you send your currency to us.

A Service Built on Trust

Trust is everything in this business, and it’s the foundation of what we do. We’re incredibly proud to be the currency exchange partner for some of the UK’s most recognised organisations. You don’t have to take our word for it; our credibility is proven by our strong relationships with major names, including:

- National Charities who depend on us to process their foreign currency donations efficiently and transparently.

- Major Supermarkets and Airports that trust us to handle their currency collections smoothly.

- UK Police Forces who use our professional service for found and seized foreign money.

These partnerships are a testament to our reliability. When you choose to exchange foreign coins and notes with us, you’re using a service that’s trusted at the highest levels.

The Go-To Specialists for Leftover Currency

While plenty of places will exchange common banknotes, we specialise in the bits that others won't even look at. We make it simple to exchange foreign coins, convert that handful of leftover foreign currency from your last trip, and even get value from old or obsolete money. Best of all, you don't need to spend hours sorting it all out—just send it to us, and we'll take care of the rest.

The global currency market never stands still. A quick look at the UK's currency exchange rates against major currencies always reveals interesting trends. The pound's value against the euro, for instance, has seen plenty of ups and downs. Forecasts have shown the rate potentially reaching 1.17 EUR per GBP by November 2025, a shift that reflects wider economic stories. You can see these patterns for yourself by looking at the historical fluctuations between GBP and EUR.

Ready to unlock the cash hiding in that drawer of forgotten currency?

Start Your Exchange on Our Homepage Today!

A Few Common Questions About Currency Exchange

Figuring out foreign exchange can feel a bit like navigating a maze. To help you compare currency exchange rates in the UK and make a smart decision, we’ve answered some of the questions we hear most often.

What’s the Cheapest Way to Exchange Currency in the UK?

For the usual banknotes still in circulation, you'll almost always find that online specialist services beat the rates offered on the high street or at airport kiosks. Their lower overheads mean they can pass the savings on to you.

But what about leftover foreign currency? When it comes to coins and old banknotes that most places refuse, a dedicated online buyback service is often your only option to get any money back. The trick is to look past the advertised rate and compare the total amount you’ll receive after all fees and spreads are factored in.

Can I Exchange Foreign Coins at a UK Bank or Post Office?

The answer is almost always a hard no. High street banks and the Post Office simply aren’t set up to handle foreign coins. The cost of sorting, counting, and processing them is just too high, so they stick exclusively to banknotes from major currencies.

We actually started our service to solve this exact problem. We specialise in exchanging the foreign coins that everyone else leaves behind, and our fast, easy, and hassle-free process means you don’t even need to sort them out first.

How Can I Find the Real-Time Currency Exchange Rate?

For a live, unfiltered look at exchange rates, check out major financial news sites like Google Finance or Reuters. They show the 'mid-market' rate, which is what banks use to trade with each other. Think of it as the purest form of the rate and the perfect benchmark to measure any quote you’re given.

The rate you're offered will always be slightly different to include the provider's service margin, known as the spread. The smaller the spread, the better the deal for you.

What Should I Do with Old, Out-of-Circulation Foreign Currency?

Once a currency is out of circulation, you can't spend it in shops, and mainstream exchange providers will turn it away. But that doesn't mean it's worthless.

Specialist services like ours can often exchange foreign coins and notes long after they've become obsolete. Our 100% guaranteed process makes it simple to turn that otherwise useless currency into real cash, unlocking the hidden value in your collection. As a service trusted by major UK charities and airports, we provide a reliable solution you can count on.

Ready to finally get some value from that drawer full of leftover coins and old notes? At We Buy All Currency, our process is fast, easy, and secure.