Mastering Gift Aid Eligibility for Donations

Posted by: Ian Stainton • 27 Sep 2025

Gift Aid is one of the simplest yet most powerful ways to make your charitable donations go further. It's a UK government scheme that lets charities reclaim the basic rate tax you’ve already paid on your donation, boosting its value by a whopping 25%—and it doesn’t cost you an extra penny.

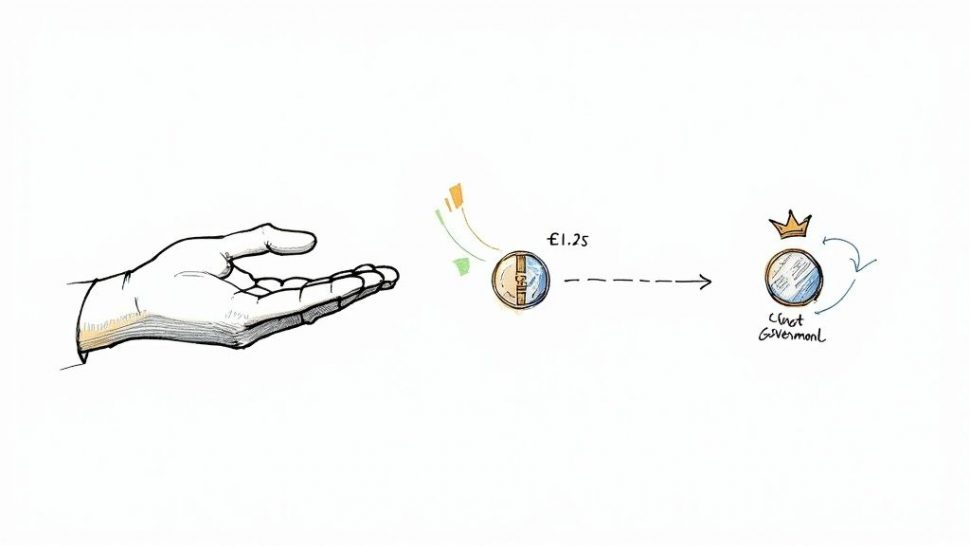

So, if you donate £10, the charity can claim an extra £2.50, turning your gift into £12.50. All it takes is for you, as a UK taxpayer, to have paid enough tax to cover the amount the charity will reclaim. It’s a small step that makes a massive difference.

How Does Gift Aid Actually Work?

Think of Gift Aid as a tax refund that you get to redirect straight to your favourite cause. When you earn money, you pay tax on it. When you then donate some of that money and make a Gift Aid declaration, you're essentially giving the charity permission to ask the government for that tax back.

It’s a vital lifeline for the third sector. This straightforward process turns every £1 donated into £1.25, significantly amplifying the financial support charities receive. For the donation to qualify, you just need to be a UK taxpayer who has paid enough Income or Capital Gains Tax in that tax year to cover the 25% the charity is reclaiming. You also need to be making the donation voluntarily, without getting anything substantial in return.

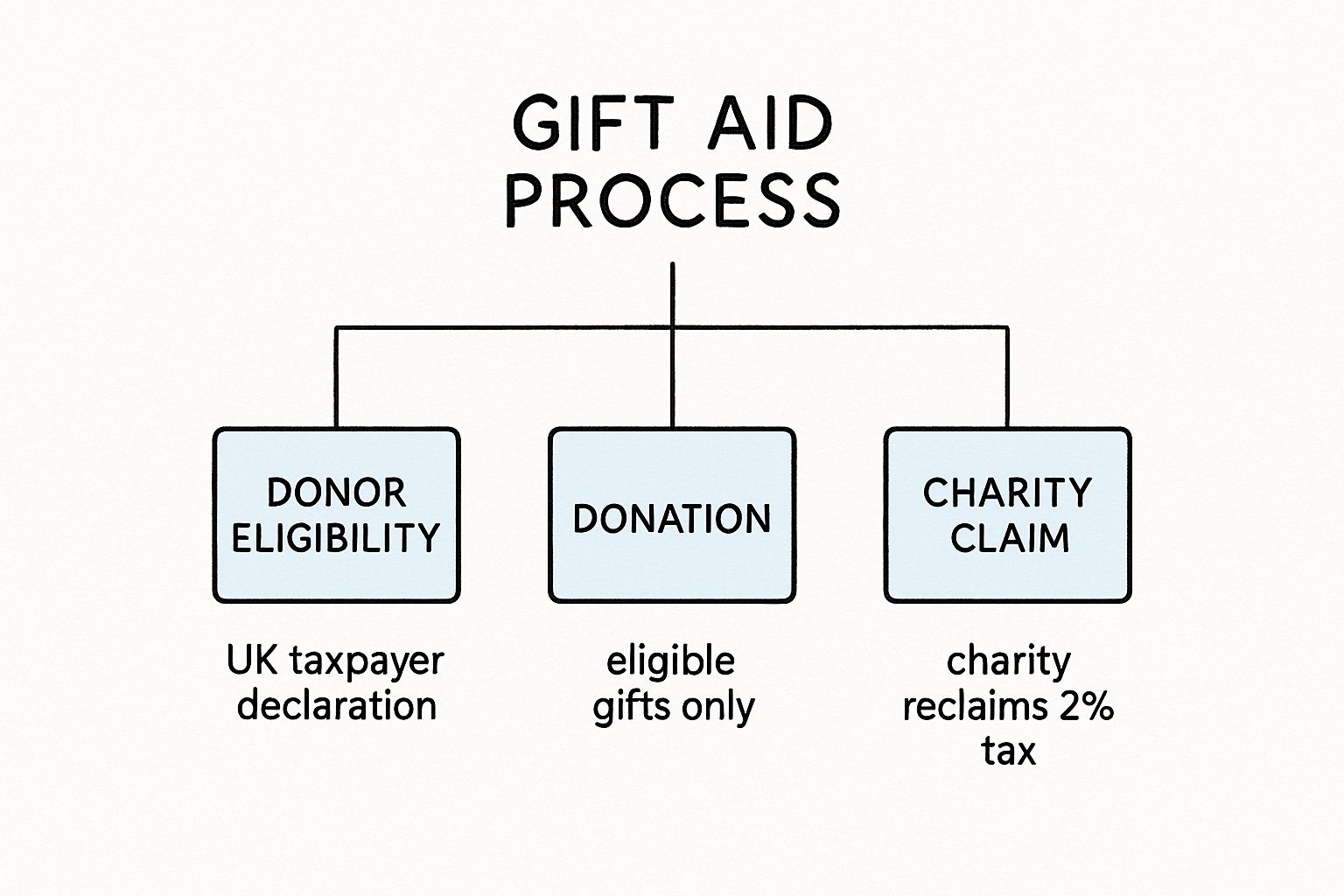

The whole process is designed to be simple, flowing from you to the charity, as this diagram shows.

As you can see, it all comes down to three key things: the donor being eligible, the donation being made, and the charity putting in the claim.

Gift Aid Eligibility Checklist at a Glance

Not sure if your donation qualifies? This quick checklist breaks down the key requirements for both you and the charity.

| Eligibility Requirement | For Donors | For Charities & CASCs |

|---|---|---|

| UK Taxpayer Status | You must be a UK taxpayer. | Not applicable. |

| Sufficient Tax Paid | You must have paid enough Income or Capital Gains Tax in the tax year to cover the Gift Aid on all your donations. | Not applicable. |

| Charity Recognition | You must donate to a charity or CASC recognised by HMRC. | Must be registered with the Charity Commission (or another regulator) and recognised by HMRC for tax purposes. |

| Donation Type | Must be a personal donation of your own money (not from a company). | The gift must be a qualifying donation. |

| No Major Benefits | You cannot receive a significant benefit in return for your donation. | The value of any benefits given to the donor must not exceed specific limits. |

| Gift Aid Declaration | You must complete a valid Gift Aid declaration for the charity. | A valid declaration must be held for each donor. |

Following these points ensures your generosity can have the maximum possible impact.

Don’t Forget Your Leftover Holiday Money

We’ve all been there—you get back from a trip abroad with a pocketful of foreign coins and a few leftover notes. It often sits in a drawer, forgotten. But what if that spare change could be a powerful tool for giving?

While you can’t claim Gift Aid directly on donations of foreign currency, we offer a simple, hassle-free way to convert foreign coins and banknotes into pounds sterling first.

You don't even need to sort your coins. Our fast and 100% guaranteed process makes it incredibly easy. Once converted, your sterling donation is then fully eligible for Gift Aid, stretching its value even further. We're trusted by some of the biggest names—from major charities and supermarkets to airports and police forces—to handle this conversion securely and efficiently.

It means your leftover holiday cash can become a much bigger contribution to a cause you believe in. We make it easy to exchange foreign coins and donate foreign coins to charity, turning loose change into significant support. To see how this fits into the bigger picture of giving, take a look at our guide on charity donation tax deductions. It’s all about making sure your generosity achieves its full potential.

How Donors Can Confirm Their Eligibility

Working out if you’re eligible for Gift Aid is a lot more straightforward than you might think. It all comes down to a simple rule that often trips people up: you just need to have paid enough tax.

The key thing to remember is that it’s not about your salary, but about the total amount of UK tax you’ve paid in that tax year (from 6th April to 5th April). Think of it like a pot of money sitting with HMRC. For every £1 you donate, the charity can claim back 25p. Your tax 'pot' just needs to have enough in it to cover the 25p for every £1 you’ve donated to all charities in that year.

So, let's say you donate a total of £100 in one tax year. To make that donation eligible for Gift Aid, you simply need to have paid at least £25 in either Income Tax or Capital Gains Tax during that same period. It’s just a check to make sure the government isn’t refunding tax that you never paid in the first place.

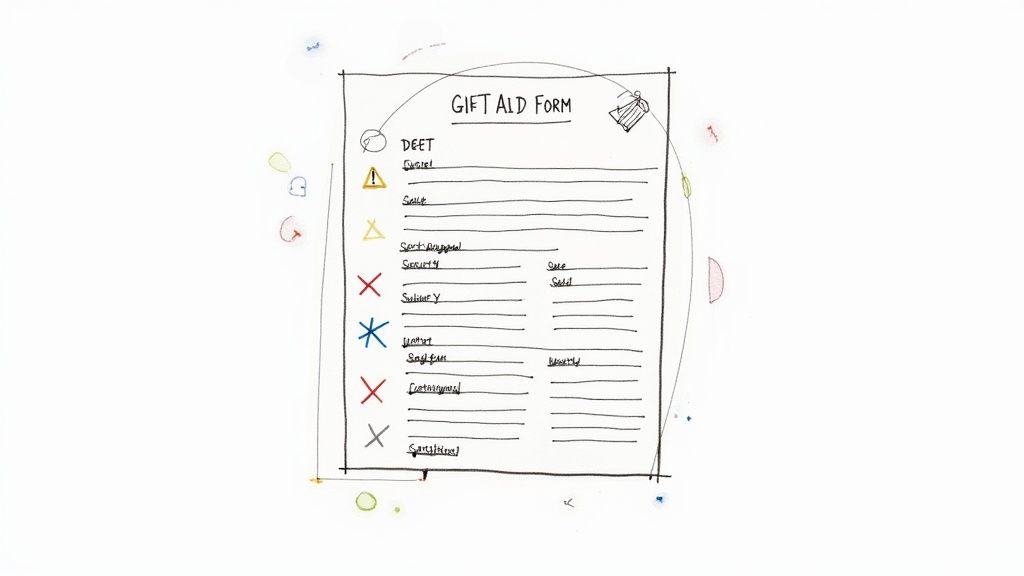

The Crucial Gift Aid Declaration

This is the most important part of the whole process. A Gift Aid declaration is essentially your permission slip. It's the document that tells the charity, "Yes, you have my authority to reclaim the tax on my donation from HMRC." Without it, they can't claim a penny, even if you're a top-rate taxpayer.

Filling one out is usually just a case of ticking a box and giving your name and address. It’s incredibly quick, and that single action can cover all your future donations to that charity, plus any you’ve made in the last four years.

A single Gift Aid declaration acts as a powerful, ongoing instruction. It’s your way of saying, "Yes, please boost my donations whenever I give," unlocking 25% more value for the cause you support with minimal effort.

Handling Common Donation Scenarios

Life isn’t always simple, and neither are donations. Here’s how Gift Aid works in a few common situations, so you can make sure your generosity always has the biggest impact.

- Joint Bank Accounts: If you and your partner give from a joint account, the declaration needs to come from the person who has paid enough tax to cover it. If you’re both taxpayers, you can simply make separate declarations for the amounts you each contribute.

- Donating on Behalf of Others: You can only claim Gift Aid on your own money. If you do a whip-round at work or collect cash from friends, you can't make a declaration on the grand total. Each person who contributed would need to make their own declaration to the charity.

- Higher-Rate Taxpayers: This is a fantastic extra benefit. If you pay tax at the higher (40%) or additional rate (45%), you can personally claim back the difference between your tax rate and the basic rate on your donation. You do this through your Self Assessment tax return.

Understanding these rules ensures every pound you give works as hard as possible. It's a similar principle if you want to donate foreign coins to charity. To make your donation count for Gift Aid, you first need to convert it into sterling – a service we can help with. For more tips, check out our guide on where to donate foreign coins.

Eligibility Rules for Charities and Sports Clubs

Before a charity or Community Amateur Sports Club (CASC) can even think about claiming Gift Aid, it needs to get the official nod from the government. It’s not just about doing good work; your organisation has to be formally recognised by HM Revenue & Customs (HMRC) for tax purposes. This is the first, non-negotiable step that opens the door to boosting donations by 25%.

This usually means getting registered with the right regulator, like the Charity Commission for England and Wales, and then applying directly to HMRC. Once you're approved, your organisation can tap into various tax reliefs, and Gift Aid is arguably the most valuable of them all. It's a bit of admin, but it’s absolutely essential for turning a supporter's generosity into the biggest possible impact.

What Donations Are Eligible for Charities

With HMRC recognition sorted, the next piece of the puzzle is understanding which donations actually qualify. The golden rule is that the donation must be a genuine gift. In simple terms, it's a voluntary payment made from an individual's own money, and they can't get anything significant back in return.

Straightforward cash donations are the bread and butter of this, of course. But what about other types of giving? A surprisingly common one for charities is leftover foreign currency from supporters' holidays.

Gift Aid cannot be claimed directly on foreign money. The currency must first be converted into sterling. The resulting cash amount then becomes a fully eligible donation, ready for the 25% boost.

This is exactly where we come in. We offer a fast, 100% guaranteed, and completely hassle-free way to exchange foreign coins and notes. You don't need to sort a thing—just send us the mixed currency, and we handle the conversion into sterling for your charity. It's a simple process, relied on by major charities, supermarkets, and police forces, that transforms otherwise useless coins and notes into vital, Gift Aid-eligible funds.

The Importance of Meticulous Record-Keeping

Successful Gift Aid claims live and die by the quality of your records. For every single donation you want to claim on, you must have a valid Gift Aid declaration from the donor. Think of this declaration as your concrete proof that they’ve given you permission to reclaim the tax on their behalf.

Your records need to create a clear, unbroken trail linking each donation back to the right donor and their specific declaration. This means keeping track of:

- Donor details: You'll need their full name and home address to identify them as a UK taxpayer.

- Donation amounts and dates: Accuracy here is key, as HMRC can and does check.

- Confirmation of declarations: You have to be able to show that a valid declaration was in place for every donation claimed.

Being disciplined with your record-keeping is what makes your claims compliant and ultimately successful. This careful approach not only secures every pound you're entitled to but also protects your charity from any potential headaches with HMRC down the line.

To start turning your supporters' leftover currency into funding, just visit our homepage and see how easy it is to get started.

What Kind of Donations Qualify for Gift Aid?

It’s a common misconception that every pound given to a charity automatically gets the 25% Gift Aid boost. The truth is a little more specific. At its heart, Gift Aid is designed for genuine gifts—money you give freely without expecting anything significant in return.

Think of it as the difference between a pure donation and a purchase. Dropping cash into a collection bucket is a perfect example of a qualifying gift. Even the sterling value you get from exchanging foreign coins counts. But buying a raffle ticket at a fundraiser? That's different. You're paying for a chance to win a prize, so it’s not just a gift anymore.

The same logic applies when you buy event tickets or bid on items at a charity auction. Because you’re receiving something of value for your money, it's considered a payment, not a donation. This distinction is the key to whether Gift Aid can be claimed.

A Quick Guide to Common Donations

To make things clearer, let's break down which common types of contributions are eligible for Gift Aid and why.

| Type of Contribution | Eligible for Gift Aid? | Reason |

|---|---|---|

| Cash or card donations | Yes | This is a straightforward, voluntary gift with nothing received in return. |

| Charity memberships | It depends | If membership only offers the right to vote at an AGM, it's usually eligible. If it provides free entry or significant discounts, it likely isn't. |

| Raffle or lottery tickets | No | You are paying for a chance to win a prize, which is a benefit. |

| Sponsored events (e.g., marathons) | Yes | The money raised from sponsors is a direct donation to the cause. |

| Charity auction bids | No | You are buying goods or services. The payment is for what you receive. |

| Event admission tickets | No | The ticket fee is a payment for entry to an event, not a voluntary gift. |

| Donations from companies | No | Gift Aid is a personal tax relief. Companies get their own tax relief on donations. |

This table shows just how important the 'no significant benefit' rule is. It's the central pillar that ensures Gift Aid is used as intended—to boost genuine charitable giving.

What About a Small Thank You? The Donor Benefit Rules

Charities often want to show their appreciation with a small token, like a pin badge or a newsletter. Does this ruin the Gift Aid claim? Thankfully, no. HMRC has set out clear ‘donor benefit’ rules to handle exactly this situation.

These rules allow for small thank-you gestures as long as their value stays below a certain threshold. It’s a pragmatic approach that keeps the focus on generosity while allowing charities to engage with their supporters.

Think of it this way: a small token is a 'thank you', not a 'transaction'. If the value of what you get back is too high, it crosses the line and invalidates the Gift Aid claim on the whole donation.

The benefit limits are tiered based on how much you donate. Here’s how it works:

| Donation Amount | Maximum Value of Benefit You Can Receive |

|---|---|

| £0 – £100 | 25% of the donation value |

| £101 – £1,000 | A flat £25 |

| Over £1,000 | 5% of the donation value (up to a max of £2,500) |

Putting it All Together: Real-World Examples

Let's look at how these rules play out in common fundraising scenarios.

If you run a marathon for charity, the sponsorship money your friends and family give is a textbook example of an eligible donation. They are giving directly to the cause. However, if the charity requires you to pay your own entry fee, that fee typically won't qualify for Gift Aid because you're paying to participate in an event.

Charity auctions are another great example. The amount you bid for an item? Not eligible, because you're buying something. But what if you make an extra, purely voluntary cash donation on top of your winning bid? That extra amount can be Gift-Aided.

Understanding these nuances helps everyone make the most of the scheme. And its impact is huge. The scale of these payments varies widely, showing how vital Gift Aid is for organisations of all sizes. For instance, projections for 2025 show around 23,050 organisations receiving under £1,000 each, while 190 organisations are expected to receive over £1 million each. You can read more on UK charity tax relief statistics on the government's website.

Navigating the Nuances: Gift Aid's Special Cases

While the standard rules of Gift Aid eligibility cover most simple cash donations, things can get a bit more complex. What about situations like company donations, membership fees, or even legacies? Digging into these special cases reveals just how flexible tax-efficient giving can be, helping both donors and charities make every penny count.

A frequent point of confusion is around company donations. It seems logical that a business gift should qualify, but Gift Aid is specifically a tax relief for individuals. So, while a company's donation isn't eligible, the business can instead claim Corporation Tax relief on the gift. It's a different mechanism, but it still provides a valuable financial benefit for corporate generosity.

Then you have non-cash gifts, like shares or property. These aren't cash, but they can be incredibly tax-efficient for the donor. An individual can claim Income Tax relief on the value of listed shares they donate, turning a portfolio asset into a powerful charitable contribution.

What About Exempt Charities?

Some organisations, like academy trusts, are known as ‘exempt’ charities. This simply means they're regulated by a government department rather than the Charity Commission, but they can absolutely still claim Gift Aid. For many schools facing tight budgets, this represents a major, often overlooked, source of income.

Think about it: an academy trust can claim Gift Aid on voluntary donations from UK taxpayers, bumping that income up by 25% without the donor paying anything extra. This can apply to general fundraising campaigns, voluntary contributions towards school trips (provided certain conditions are met), and of course, donations from alumni. It’s a perfect example of how the scheme is designed to support a broad range of community-focused organisations. You can find out more about how academy trusts can maximise Gift Aid income.

Legacies and In-Memory Donations

Legacies left in a will are another area with special tax rules. Gift Aid doesn't apply in the same way, but there's a different, powerful incentive at play. If you leave 10% or more of your net estate to charity, the Inheritance Tax rate on the rest of your estate can be reduced from 40% down to 36%. It’s a significant incentive that encourages legacy giving.

At the end of the day, the principle behind all these special cases is the same: making personal generosity go further. Whether it's a legacy, a membership, or leftover holiday money, there are smart ways to maximise its value for a good cause.

And what about that jar of foreign coins you have tucked away? While you can't apply Gift Aid to the coins themselves, you can donate foreign currency to charity once it's been converted into sterling. Our service makes this incredibly easy. We turn that forgotten currency into a cash donation that is eligible for Gift Aid, meaning it can be boosted by another 25%. We handle the whole process, making it a simple, hassle-free way to support your favourite charity.

Got Questions About Gift Aid? We’ve Got Answers

Gift Aid can seem a bit tricky at first, but once you get the hang of it, it's incredibly straightforward. To clear up some of the common head-scratchers, we've put together answers to the questions we hear most often from both donors and charities. Let's make sure you can navigate the process with confidence.

What Happens If I Stop Paying Tax?

This is a really important one. If your circumstances change and you're no longer a UK taxpayer, you need to let any charities you support know right away so they can cancel your Gift Aid declarations. It’s a crucial step.

Why? Because if a charity claims Gift Aid on your donation after you've stopped paying enough tax, HMRC will come to you to repay the amount the charity received. A quick phone call or email to the charity is all it takes to avoid any hassle down the line.

Can I Use Gift Aid on Donated Foreign Coins?

The short answer is no, not directly. Gift Aid can only be claimed on donations made in pounds sterling.

But there's a simple and brilliant workaround. By exchanging your foreign coins and notes for sterling first, that cash donation then becomes fully eligible for Gift Aid. This is where our service comes in handy.

We make the whole process incredibly easy. You don't even have to sort through your coins. Just send us your leftover foreign currency, and we’ll handle the conversion into sterling for you. Once you donate that amount, the charity can add the 25% Gift Aid boost, turning old holiday money into a much more powerful gift. It’s a fast, hassle-free, and 100% guaranteed service trusted by major charities, airports, and supermarkets across the UK.

Converting your leftover currency first is the key that unlocks its Gift Aid potential. It transforms forgotten change from a simple donation into a supercharged contribution, effortlessly increasing its value for the cause you care about.

Does Gift Aid Apply to Payroll Giving Donations?

This is a common point of confusion, but Gift Aid doesn't apply to donations made through a payroll giving scheme. Think of them as two separate, but equally brilliant, tax-efficient ways to give.

Payroll giving donations are taken from your salary before tax is deducted, meaning you get your tax relief straight away. Claiming Gift Aid on top would essentially be claiming the same tax back twice, which is why it's not allowed.

How Far Back Can a Charity Claim Gift Aid?

Charities have a generous window to work with—they can typically make a backdated Gift Aid claim for donations from the last four tax years. This is a fantastic way to capture extra funds from past generosity that might have been missed.

For this to work, two things must have been true for each of those years. First, you needed to have a valid Gift Aid declaration in place with the charity. Second, you must have paid enough tax in that specific tax year to cover the 25% being claimed on all your donations. It's another great reason to keep your declarations up to date!

Ready to turn that jar of forgotten currency into a meaningful donation? With We Buy All Currency, you can convert foreign coins and banknotes quickly and easily, with no need to sort anything. Our process is fast, easy, hassle-free, and trusted by leading UK brands. Visit our homepage to get started today!